Yesterday registered a substantial surge into big tech, but the bullishness fell short of breaking through its 50-day average and remains challenged by significant overhead resistance. With bonds remaining stubbornly bullish after the unveiling of the infrastructure proposal, the question is, can we get a day of follow-though? Keep in mind with everyone thinking about the 3-day weekend ahead, the volume could become light and price action choppy after the morning economic news reaction.

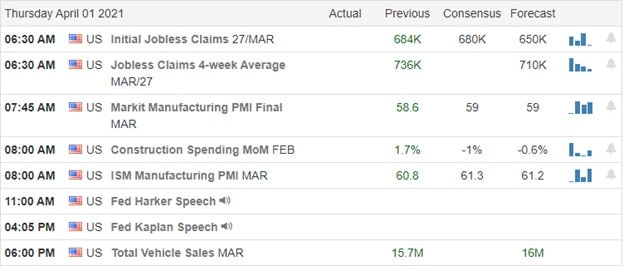

Overnight Asian markets closed green across the board, lead by Hong Kong surging nearly 2%. European indexes trade modestly bullish this morning as they await several data releases. On the first trading day of April U.S. points to modest gains ahead of Jobless Claims and ISM numbers as we slide toward the Good Friday shutdown. Plan your risk carefully.

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have 36 companies listed, but the majority are unconfirmed. Looking through the list, I can only come up with one notable report coming from KMX.

News & Technicals’

There was a surge into big tech yesterday, but overall it was a mixed bag of results, with profit-takers coming in at the close. President Biden’s $2trillion infrastructure is getting a mixed response as worries about the significant tax increases will slow economic and job recovery. Microsoft won a $21.9 billion contract for augmented reality headsets giving the stock a boost into yesterday’s close. Although the 10-year treasuries softened a bit yesterday, they stubbornly hold above 1.71% as inflation concerns continue.

While there was a general sense of bullishness in the market yesterday, in reality, the DIA, SPY, and IWM were in a resting mode while big tech enjoyed a substantial surge of energy. However, at the end of the day, the QQQ could not break above its 50-day average and still has considerable overhead resistance. The SPY missed setting a record high by just a few ticks and then ran into some profit-takers, which honestly surprised me during the end-of-quarter window dressing. The Absolute Breadth Index continues to raise the concern that overall momentum is lacking, and the nasty whipsaw of late keeps us guessing what comes next as the VIX chops with uncertainty. Plan your risk carefully as we head into the Good Friday shutdown and the 3-day Easter weekend.

Trade Wisely,

Doug

Comments are closed.