The Friday early bullishness ended with a nasty pop and drop, extending the short-term substantial oversold condition of the index charts. However, a ray of relief rally hope may have been left behind with the ViX unable to make a new high and some possible tweezer bottom candle patterns. That said, I think we should keep a close eye on overhead price resistance levels for more bearish activity with global economic conditions slowing. Expect price action to remain challenging in the days and weeks ahead.

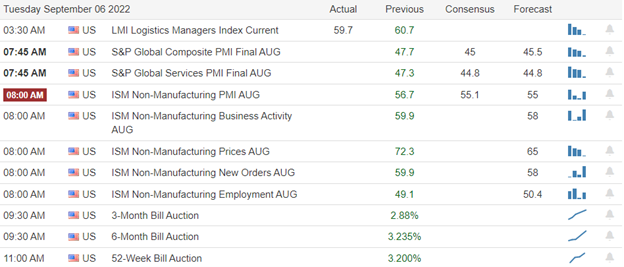

Asian markets traded mixed as we slept with the Australian Central Bank raising rates by 50 basis points. European markets trade in the green hoping for a bit of relief as they welcome a new U. K. Prime Minster. Finally, with a light day of earnings, PMI, and ISM numbers around the corner, U.S. futures point to a bullish open, hoping to relieve recent selling pressure. Plan your risk carefully and expect volatility to remain challenging.

Economic Calendar

Earnings Calendar

We have a light earnings calendar to begin this shortened trading week. Though there are about 20 companies listed, most are small, low-volume companies. Notables for today include COUP, GWRE & PATH.

News & Technicals’

CVS said it would acquire Signify Health for $30.50 per share in cash. The deal marks a big push by CVS into the in-home health care space. Signify announced its decision to explore strategic alternatives in early August. Analysts said that OPEC+’s decision to implement a small production output cut is more of a political statement and symbolic message sent by the alliance. On Monday, the group announced a small oil production cut of 100,000 barrels per day to bolster prices. Just last month, OPEC+ decided to raise oil output by the same target of 100,000 barrels per day. The analysts were also skeptical about the efficacy of price caps on Russian oil. As Liz Truss becomes Britain’s new prime minister on Tuesday, questions are being raised over her plans for the U.K.’s historic financial district: the City of London. A re-merging of the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) could be on the cards, but one former insider asks if it’s change for change’s sake. The “battle” to deregulate the banking sector is like “winding the clock back to the pre-2008 global financial crash,” campaign group head Fran Boait said.

“I have said this a number of times this year and I’m educating policymakers. Look, the worst is still to come,” Uniper CEO Klaus-Dieter Maubach told CNBC on Tuesday at Gastech 2022 in Milan, Italy. On Friday, Russia’s state-owned energy giant Gazprom indefinitely halted gas flows to Europe via a major pipeline, stoking fears that parts of Europe could be forced to ration energy through winter. Uniper, as Germany’s biggest importer of gas, has been hit hard by vastly reduced gas flows via pipelines from Russia, which have sent prices soaring. Apple is gaining momentum in online advertising, while Facebook and Google appear to be losing steam. Apple’s ad platform for app developers mirrors the rise of Amazon’s ad business for retailers. TikTok overtook Snap at the bottom tier of online ad platforms. Bond yields traded higher Tuesday morning, with the 12-month at 3.46%, the 2-year at 3.45%, the 5-year at 3.35%, the 10-year at 3.24%, and the 30-year at 3.38%.

Friday’s pop and drop may not have been a big surprise, but it was disappointing all the same due to the short-term, substantial oversold condition on the index charts. However, there may be a bit of a silver lining with some tweaser bottom candle patterns left behind and a VIX unable to break recent highs. Perhaps this holiday-shortened week can produce some needed relief to the selling! However, please don’t mistake my hopefulness for some relief as bullishness. I think a rally could set up short positions as the world economic picture continues to slow ahead of the central bank rate increases. If traders extend their holiday plans, it is possible we could see a light volume day but continue to plan for price volatility in the days ahead.

Trade Wisely,

Doug

Comments are closed.