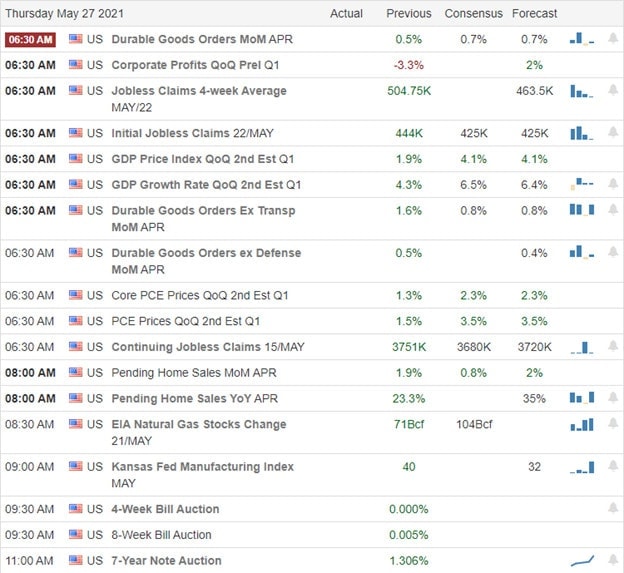

Despite all the premarket blustering trying to inspire the bulls the last couple of mornings, the indexes remain stuck near overhead resistance. NVDA reported an 84% increase in sales last quarter, but the stock is nearly unchanged this morning as the market seems to struggle with momentum. How we open today will depend on the reaction to the Durable Goods, GDP, and Jobless Claims numbers. I think it is fair to say anything is possible. However, keep in mind the coming 3-day weekend, and don’t be surprised if trading volumes quickly decline after the morning session as traders head out to extend their time off.

During the night, Asian markets traded mixed in a somewhat choppy session. European markets traded mixed this morning and primarily flat, cautiously waiting on U.S. Economic data. U.S. futures have rallied off of overnight lows as earnings roll out, and we wait on crucial data points to be revealed.

Economic Calendar

Earnings Calendar

We have our most significant day of earnings data this week, with 40 companies listed on the calendar. Notable reports include BBY, CRM, ADSK, BOX, BURL, COST, DELL, DG, DLRT, GPS, GCO, HPQ, MDT, OLLI, SAFM, ULTA, VEEV, & VMW.

News & Technicals’

NVDA crushed 1st quarter results with sales up 84% compared to last year and sold $155 million in crypto mining chips. Interestingly the stock is basically unchanged this morning. The US and China talked on the phone for the first time under the Biden administration and were stated as candid, pragmatic, and constructive. It is beginning to look more and more likely that the pandemic origin was from a Wuhan lab where game of function activities took place. After ending the Trump investigation immediately after entering office president, Biden has now ordered an investigation. Russia has decided it will not make Covid vaccines compulsory for its citizens, with Putin telling officials on Wednesday that it would be “counterproductive.”

Though there was an effort in the premarket futures to inspire the bulls yesterday morning, the indexes remained stuck near overhead resistance. Overall we chopped in a very narrow range in the DIA, SPY, and QQQ while IWM enjoyed a surge of activity bolstered by oil numbers. This morning futures appear uninspired after the huge beat from NVDA. However, they have significantly improved from overnight lows. That said, with Durable Goods, GDP, and Jobless Claims before the open, anything is possible when trading begins today. As you plan your risk, keep in mind the coming 3-day weekend and the possibility that trading volumes could quickly decline if traders wrap up their week early.

Trade Wisely,

Doug

Comments are closed.