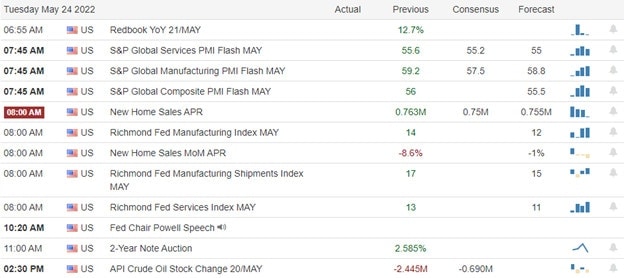

Although the Dow enjoyed a steady relief rally, the SPY, QQQ, and IWM struggled to maintain bullish momentum. Facing potentially market-moving economic data the rest of the week, the bulls may have missed their chance to improve the index chart technicals. This morning traders will turn their attention to PMI and Housing data along with another round of retail earnings reports and more comments from Jerome Powell at 12:20 PM Eastern. As you plan forward, keep in mind the Durable Goods report before the bell that’s expected to decline and the FOMC minutes to keep things interesting.

Asian markets had a rough night of selling, seeing red across the board with possible tariff cuts on Chinese goods. This morning, European markets also have a bearish look showing red selling across all indexes. Ahead of earnings and economic data, U.S. futures point to a bearish open as the bear look to claw back some of Monday’s rally. Get ready for another wild day of price action!

Economic Calendar

Earnings Calendar

The Tuesday earnings calendar has about 50 companies listed with the heavy retail focus continuing though many are unconfirmed. Notable reports include BBY, ANF, A, CAL, CSIQ, CTRN, DSX, ESLT, INTU, NTES, JWN, WOOF, RL, SBLK, TOL, URBN, & ZEPP.

News & Technicals’

A growing number of economists and money managers sound the alarm over a possible return to1970s style stagflation as the Federal Reserve moves to tame Sky-high inflation. According to a recent survey from BOA Global Research, about 77% of investment fund managers now say they see “ below-trend growth and above-trend inflation” as the most likely outcome for the economy over the next year. Walmart is expanding drone deliveries across six states with the operator DroneUp, bringing its total network to 37 sites by year-end. The big-box retailer said it would be able to deliver items like batteries and Hamburger Helper to 4 million households in parts of Arizona, Arkansas, Florida, Texas, Utah, and Virginia. Walmart has been testing how drone deliveries could drive e-commerce growth and turn stores into a way to outmatch Amazon on speed. A survey by PwC of more than 52,000 workers in 44 countries indicates the Great Resignation is set to continue. Some 35% say they plan to ask their employers for a pay raise, with the pressure highest in the tech sector. More money is the biggest motivator for a job change, yet finding fulfillment at work is “just as important,” according to PwC. Snap will miss its revenue and adjusted earnings targets in the current quarter, CEO Evan Speigel warned on Monday in a note to employees. The social media company will also slow hiring through the end of the year as it looks to manage expenses. Zoom narrowly beat on the top line but sailed past estimates for earnings while also giving a better-than-expected outlook for the second quarter. Before Monday’s earnings report, Zoom shares had lost about 85% of their value since October 2020. The company reported five straight quarters of triple-digit revenue growth during the pandemic, but expansion is now much more challenging. Treasury yields declined in early Tuesday trading, with the 10-year dipping to 2.81% and the 30-year trading lower to 3.02%.

Monday saw a steady rally in the Dow while the SPY, QQQ, and IWM rallied but struggled to maintain bullish momentum to squeeze out short traders. However, with potential market-moving economic the rest of the week, the bulls may have missed their chance to improve the chart technicals as the data points ahead may favor the bears. Consensus expects the PMI and New Home Sales to weaken, and then we have more comments coming from Jerome Powell at 12:30 PM to keep traders guessing the price volatility likely high. Ahead of the data with more disappointing retail news from SNAP, futures look to take back a significant portion of Monday’s relief at the open.

Trade Wisley,

Doug

Comments are closed.