The Employment Situration report continues to not only indicate a strong labor market along with rising wages raised some worries about inflation as the dollar rallied and the 10-year bond yield rose back above 4%. We kick off the new week with a light earnings and economic calendar and it pretty much stays that way until until Thursday we we get the next reading on CPI. So as we hurry up and wait don’t be surprised to see just about anything in the price action including range bound chop as we wait in anticipation.

Asian markets closed the day mostly lower with the tech heavy Hong Kong leading the selling down 1.88% followed by Shanghai down 1.42%. Europeian markets trade mostly lower this morning with modest gains and losses in a cautious session waiting on pending inflation data. However, the U.S. futures point to a mixed open with as tech tries to bounce back with Dow under pressure due to the bad news for Boeing.

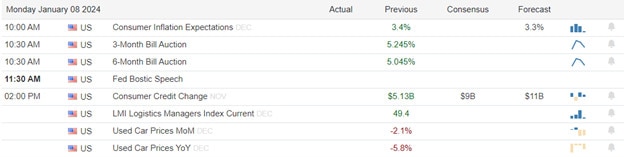

Economic Calendar

Earnings Calendar

Notable reports for Monday ACCD, HELE, & JEF.

News & Technicals’

Boeing, the aerospace giant, saw its shares plunge 8% in pre-market trading at 4:30 a.m. ET on Monday. The drop came after the Federal Aviation Administration (FAA) issued an emergency order on Saturday, requiring 171 Boeing planes around the world to undergo inspections before they can fly again. The order was triggered by an incident on Friday, when an Alaska Airlines flight suffered a blowout in one of its engines, forcing it to make an emergency landing. The National Transportation Safety Board (NTSB) is investigating the cause of the engine failure.

Audacy, a leading company in radio and podcasting, has announced that it will file for Chapter 11 bankruptcy protection to deal with its heavy debt burden. The company said that it has reached a restructuring agreement with its creditors, which will enable it to cut its total debt by 80%, from about $1.9 billion to about $350 million. The company said that the bankruptcy process will not affect its operations or its content offerings.

A $1.59 trillion spending deal was reached by congressional leaders on Sunday, as the government tries to prevent a possible shutdown. The deal sets the overall budget for the 2024 fiscal year, dividing $1.59 trillion between defense and non-defense spending, with $886 billion for the former and $704 billion for the latter. The deal shows that Johnson and Schumer, the leaders of the Senate, are cooperating, but it does not guarantee a funding agreement, as there are still policy disputes between the parties.

Cosco, a Chinese state-owned shipping company, has stopped its services to Israel via the Red Sea, amid rising conflicts in the vital waterway. The Red Sea connects the Mediterranean Sea and the Indian Ocean, and is a key route for global trade. Israeli state media reported that Cosco’s decision was based on security concerns, but did not reveal any further details. According to Globes, an Israeli financial news source, Cosco’s move could affect Israel’s imports and exports.

On Friday The U.S. employment data revealed a strong labor market, causing major indexes to swing between ups and downs. Job growth picked up, boosting the economy, but wage growth was higher than expected, raising inflation fears. The 10-year Treasury yield rose above 4%, hurting the defensive sectors, which are more affected by interest rates. However, today’s market changes were not very significant, and despite stocks finishing the first week of the year lower, only slightly correcting from the parbolic nine week bullish run. The FAA grounding sozens of 737 Max9s aircraft has the market feeling a bit bearish but little on the earnings and economic calendar anything is possible. In fact as we continue to wait for the official kickoff of earnings and the CPI and PPI reports later this week traders should consider the possibility of choppy range bound consolidations through mid week.

Trade Wisely,

Doug

Comments are closed.