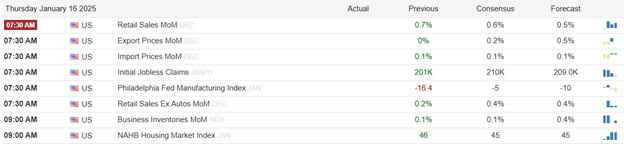

S&P 500 futures climbed on Thursday, following the benchmark index’s best performance since November, driven by a favorable inflation report and strong bank earnings. Investors are eagerly awaiting further economic insights, with the December retail sales report anticipated to show a 0.5% increase, slightly down from November’s 0.7% rise, according to Dow Jones estimates. Additionally, weekly jobless claims are expected to be released. Earnings reports from Morgan Stanley and Bank of America are also on the docket, concluding the earnings season for major banks.

European markets experienced a positive surge on Thursday, driven by impressive performances in the luxury and technology sectors. Luxury stocks soared, particularly those of Cartier, which reported strong results. This uplift was mirrored in the shares of France’s LVMH, Kering, and Christian Dior, all of which saw gains of around 8%. Retailers such as Moncler, Burberry, Swatch, and Hermes also performed well, clustering at the top of the Stoxx index. Technology stocks rose by 1.87%, with chip companies like ASM International and Be Semiconductor benefiting from better-than-expected earnings from Taiwan Semiconductor Manufacturing Company.

Asia-Pacific markets saw a positive trend on Thursday, with most indices recording gains. Korea’s central bank maintained its benchmark interest rate at 3%, defying expectations. This decision seemed to bolster investor confidence, as the Kospi rose by 1.23% and the Kosdaq by 1.77%. The Korean won, however, weakened slightly, trading at 1,456.91 against the US dollar. In Japan, the Nikkei 225 edged up by 0.33%, while the Topix dipped marginally by 0.09%. Hong Kong’s Hang Seng index climbed 1.08%, and China’s CSI 300 saw a modest increase of 0.11%. Meanwhile, Australia’s S&P/ASX 200 advanced by 1.38%, despite a slight uptick in the unemployment rate to 4% in December from 3.9% in November.

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include BAC, FHN, IIIN, MTB, MS, PNC, UNH, & USB. After the bell reports include OZK, & JBHT.

News & Technicals’

British oil major BP announced on Thursday its plan to cut thousands of jobs as part of a significant cost-cutting initiative. The company informed staff that approximately 4,700 roles would be impacted by the proposed changes, constituting a large portion of this year’s anticipated reductions. Additionally, BP plans to reduce its contractor numbers by 3,000. These measures aim to lower costs, following CEO Murray Auchincloss’s statement last year that BP intends to achieve at least $2 billion in cash savings by the end of 2026.

Target raised its fourth-quarter sales forecast on Thursday, attributing the increase to a surge in holiday shopping both in-store and online, especially during major discount days. The retailer now expects comparable sales to grow by about 1.5%, an improvement from its previous projection of flat growth. This metric includes sales from Target’s website and stores open for at least 13 months. Despite the positive sales outlook, Target did not revise its profit forecast, suggesting that the boost in sales was driven by promotional deals. The company anticipates fourth-quarter earnings per share to range between $1.85 and $2.45.

The Biden administration announced an executive order on cybersecurity on Thursday, introducing new standards for companies selling to the U.S. government and requiring greater transparency from software providers. This move follows several high-profile ransomware attacks on entities like Change Healthcare, Colonial Pipeline, and Ascension health care system. Additionally, Microsoft revealed in 2023 that Chinese attackers had breached U.S. government officials’ email accounts, leading to a critical federal report and subsequent changes at the company. Under the new order, software vendors must prove their development practices are secure, with evidence to be posted on a government website for the benefit of all software users, as stated by Neuberger.

Although we have seen some strong big bank earnings, the regional banks appear to be struggling a bit this morning. Continue to expect wild volatility and remember we have three day weekend just around the corner with the inauguration that could easily create some bumpiness due tot the big changes that are expected.

Trade Wisely,

Doug

Comments are closed.