While all eyes focused on the approaching Florida storm it seems there was another storm brewing in currency markets this weekend. The British Sterling dropped by $1.20, and the Euro slipped to a 28-month low not to mention Argentina that is nearing total financial collapse and Lebanon declaring a state of economic emergency. Certainly, an uncomfortable backdrop for the market as new US-China tariffs took effect on Sunday and spilling August’s volatility into the beginning of September.

Overnight Asian markets closed mixed but relatively flat while Australia decided to keep interest rates unchanged. Across the pond, European markets are slightly lower across the board as they deal with the uncertainty of Brexit and the Sterling selloff. Here in the US, futures markets are trying to rally off of overnight lows ahead of a big week of economic data but still point to a substantial gap down open adding to the technical damage of the index charts. Hang on as the storm clouds continue to stir with uncertainty.

On the Calendar

On this morning’s Earnings Calendar, we have just over 34 companies reporting results. Notable reports include CONN & COUP.

Action Plan

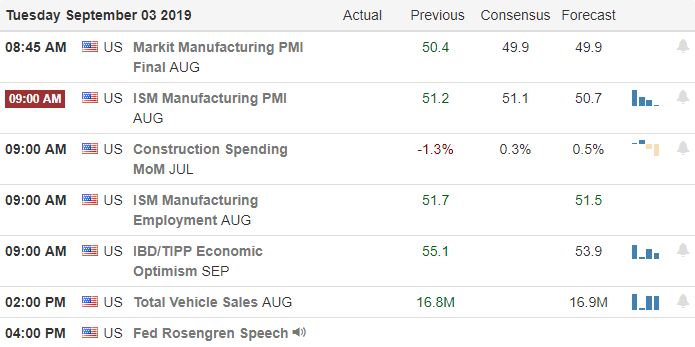

An eventful holiday weekend as Hurricane Dorian as lashes the coast of Florida, Argentina nears financial collapse, the British Sterling falls below $1.20 while the Euro slides to a 28-month low and additional US-China take effect. The Market also faces a busy Economic Calendar beginning with Housing data as well as the ISM Index today and ending the week with the Employment Situation report Friday morning. It seems the market uncertainty that plagued August markets will spillover into September keeping traders on edge and price volatility high.

Although the US Futures are currently trying to bounce off of overnight lows, it seems likely markets will open with a substantial gap lower putting pressure on hopeful traders that picked up risk heading into the weekend. With traders possibly extending their holiday vacations and the disruptions that Hurricane Dorien could produce anything is possible. Keep an eye on the gap below that was created last Thursday that could easily fill if the bears find inspiration after the morning gap.

Trade Wisely,

Doug

Comments are closed.