Equities had a rough start on Monday but stocks recovered as the investors shook off the Middle East war and spiking oil prices in favor of continuing the relief rally that began last Friday. The tech giants enjoyed the majority of bullishness as the QQQ remains the strongest of the indexes while the IWM continues to lag significantly behind. Today, we have another light day of earnings and economic reports as we wait for the September PPI and FOMC minutes on Wednesday. Consider your risk carefully as big-point moves, gaps, and reversals are possible.

Asian markets closed mixed but mostly higher with the Nikkei leading the buying up 2.43% and Shanghai modestly lower after Country Garden warned of the likelihood of more missed payments. European markets appear blissfully unconcerned about the Middle East conflict this morning decidedly bullish across the board. U.S. Futures seek to continue the relief rally suggesting a bullish open as bond yields decline with pending inflation data on the horizon.

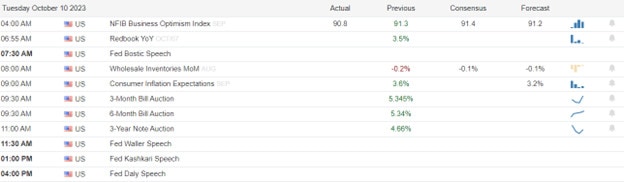

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AZZ, NEOG & PEP.

News & Technicals’

According to the World Economic Outlook report by the International Monetary Fund, the U.S. economy is expected to grow faster than the eurozone economy this year. The IMF increased its U.S. growth forecast by 0.3 percentage points to 2.1%, while it decreased its euro zone forecast by 0.2 percentage points to 0.7%. The report says that the U.S. has benefited from stronger business investment and resilient consumption, while the eurozone economies have faced challenges from higher interest rates and diverging performance. The IMF also maintained its global growth forecast of 3% for the year.

The future of generative artificial intelligence, a type of AI that can create new content such as images, text, or music, may not be as bright as some expect. A report by CCS Insight, an analyst firm, predicts that generative AI will face a “cold shower” in 2024, as the costs of running the technology will increase and the hype will fade. The report also says that smaller developers of generative AI will struggle to compete with larger players, as the technology becomes “too expensive” to operate. On the other hand, the report also forecasts that the regulation of AI in the European Union will be delayed, as the technology advances faster than the policymakers can keep up.

Country Garden, a leading property developer in China, has defaulted on a debt payment of 470 million Hong Kong dollars ($60 million). The company said that it was unable to repay the debt due to “unforeseen circumstances” and that it was seeking a waiver from its creditors. The company also warned that it faced uncertainty in its liquidity position and asset sales in the short and medium term, as the property market in China has been hit by regulatory tightening and slowing demand. The default has raised concerns about the financial health of Country Garden and other Chinese developers, who have accumulated high levels of debt in recent years.

U.S. stocks recovered from a negative start on Monday, as they shrugged off the impact of the Hamas attacks in Israel and ended the day with gains despite the declining market breath with the uncertainty ahead. Energy was the best performer, boosted by the increase in oil prices. Other sectors that did well were industrials, real estate, communication services, and utilities. Gold prices also went up 1%, partly due to the inflationary effect of higher energy prices and partly due to the demand for a safe-haven asset amid the conflict in Israel. Finding inspiration may be challenging today with little more than Fed speakers and bond auctions on the economic calendar. Earnings events are also light on numbers but a least there are a couple of notable reports for the bulls or bears to some energy. However, expect anemic volume as we wait on the key September inflation reports expected to be a major driver in the coming days.

Trade Wisely,

Doug

Comments are closed.