With stimulus money once again flowing with the stroke of the Presidential pen, the path to record highs in the SP-500 is clear for the bulls for an easy headline. Although we have several significant reports on the economic calendar this week, today is light, allowing earnings news and politics to drive the day. While a new record in the SP-500 seems likely soon, traders should watch for possible profit-taking that could begin at any time having moved up 7-days in a row.

Asian markets closed Monday mixed but mostly lower remaining cautious with the rising tensions between the US and China. However, European indexes are green across the board this morning, and US futures have recovered from overnight lows suggesting a modestly bullish open to begin the week.

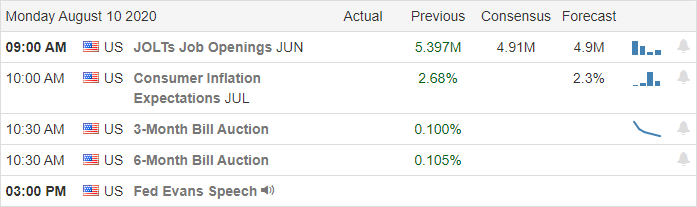

Economic Calendar

Earnings Calendar

Although the 3rd quarter earnings season starts slowing this week, Monday’s calendar remains quite busy with more than 200 companies reporting. Notable reports include ANGI, GOLD, CGC, CDR, SCOR, CEIX, DUK, AGM, GOGO, HVT, IAC, INO, IPAR, JCOM, MAR, MELI, OXY, ON, PPL, APTS, RCL, SEAS, SPG, TME, TLRY, & WKHS.

New & Technical’s

With the stroke of a pen, the President signs a series of executive orders extending coronavirus relief through the end of the year after Congress failed to reach an agreement on the stimulus bill. Those unemployed will receive $400 in additional financial support down from the $600 that lapsed over a week ago. However, it requires the State to come up with $100 of the $400 benefit, and it’s unclear if they can do so. The initial market reaction to this action showed mixed results, but the additional deficit spending has gold and silver futures flying high this morning. Some analysts say gold could ready $4000 an ounce! With the election less than 100 days away, the President also raised tariffs on aluminum reigniting the trade war with Canada, and of course, Canada retaliated in kind. This weekend the US reached another grim milestone, topping 5 million coronavirus cases. Daily infection rates have begun to level off in Florida, Texas, and California, with some mid-west, states becoming a concern as their numbers surge.

With the SP-500 just over 1% from new record highs and the stimulus money flowing again, I suspect the path is clear for the bulls to push forward. Although the index has moved higher seven sessions in a row, I can’t imagine institutions failing to reach that out for that record-high headline. However, traders will also have to stay focused on the possible profit-taking that could begin at any time. With a light day on the economic calendar, earnings results and political spin cycle are the likely drivers for today.

Trade Wisley,

Doug

Comments are closed.