Stimulus hopes created a big short squeeze rally, but the uncertainty yesterday afternoon made tremendous price volatility as market sentiment swung violently. Renewed hopes once again have US Futures pointing to a big emotional morning gap, but traders will have to be on guard for more wild price swings driven by political news sensitivity. Adding to the potential volatility is a big day of economic reports that can potentially move the market substantially.

Asian markets had a rough overnight session with the NIKKEI closed due to an electronic system failure. European markets are cautiously bullish this morning as they track developments on the US stimulus package. Ahead of a busy economic calendar, US Futures point to Dow gap up as traders speculate on a stimulus agreement. It could be a wild ride today so stay focused and flexible.

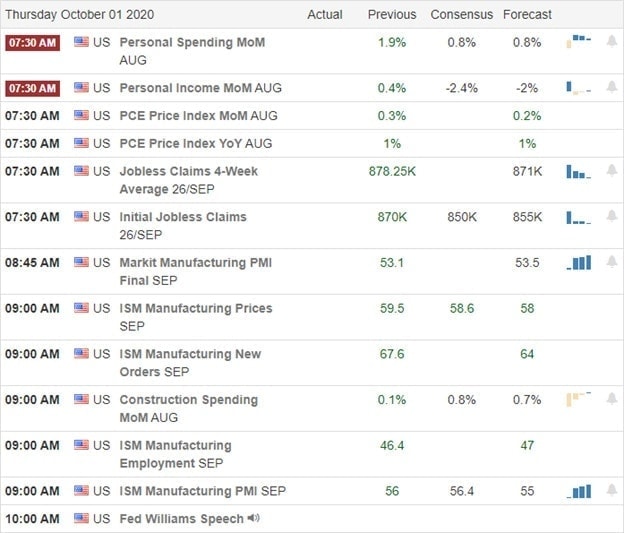

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have another light day with just 9-confirmed reports. Notable reports include CAG, PEP, STZ & BBBY.

News and Technicals’

Hopes of a new stimulus bill and some end of quarter window dressing fueled a substantial short squeeze yesterday. Unfortunately, the day ended with tremendous price volatility when the House delayed the vote on the 2.4 trillion dollar plan. The President has extended an offer for 1.2 trillion, so the standoff continues today. Airlines are moving forward to Furlow around 38,000 employees today, saying they will reverse the decision if another 20 billion in bailout funds, that’s part of the stimulus plan, is approved. The Senate passed, and the President signed a spending bill after funding briefly lapsed, avoiding a government shutdown. Asian markets had a tough night with trading suspended for a full session due to a failure in the Tokyo fully electronic system. Apparently, the backup system all failed as well.

With some hope renewed on a stimulus bill, US Futures point to another big gap-up open this morning. Traders will have to stay on their toes as any news coming out the Washington spin cycle could crate quick price reversals should congress fail. The big move yesterday improved the technicals of the index charts pushing the DIA and SPY above their 50-day averages and increased the risk due to the substantial political uncertainty. Facing another big day of economic reports, prepare for anything as this wild rollercoaster ride continues.

Trade Wisely,

Doug

Comments are closed.