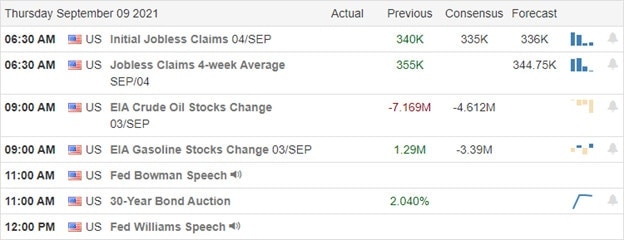

Uncertainty has begun to raise its ugly head with a stark imbalance between the 7 to 9 tech giants doing all the heavy lifting with just 47% of stocks trading above their 200-day averages. So with an ECB decision pending and Jobless Claims before the bell, will the bulls find the inspiration to defend, or will the bears find an opening to attack? Your guess is as good as mine, but the surge that occurred yesterday into real estate, utilities, and consumer staples looking for some safety is noteworthy.

Overnight Asian markets traded mostly lower, with Hong Kong plunging 2.30% on the Chinese gaming crackdown worries. This morning, European markets see only red as they await the ECB decision, with inflation hitting a 10-year high. U.S. futures also hint at a lower open with eyes on the ECB and Jobless Claims that have become troublesome of late. So buckle up; it could be a volatile open.

Economic Calendar

Earnings Calendar

We have our busiest day of the week on the Thursday earnings calendar, with 31 companies listed, several unconfirmed. Notable reports include AFRM, PLAY, HOFT, JILL, LAKE, LOVE, RLGT, COOK, VRNT, ZS, & ZUMZ.

News & Technicals’

Chinese regulators summon Tencent, NetEase, and other game companies for interviews, reminding them about the restrictions on game time for children. As a result, Hong Kong plunged 2.30% as Tencent shares fell 8.48% and NetEase dropped 11%. According to the South China Morning Post, Beijing has temporarily frozen game approvals. Treasury Secretary Janet Yellen warned House Speaker Nancy Pelosi that the mere specter of a U. S. default could have drastic consequences. Yellen said lawmakers have until some point in October before the department runs out of funds in its extended efforts. Today, we will hear about the ECB’s plan to taper and battle inflation, which is now at a 10-year high. U.S. Treasury yields dip as we wait, with the 10-year trading down to 1.321% and the 30-year falling to 1.941%.

I don’t believe I’ve ever witnessed the stark imbalance between the haves and the have not’s in the market. Only 47% of U.S. stocks are above their 200-day moving averages as 7 to 9 tech giant companies continue to do all the heavy lifting. That said, the QQQ and SPY have maintained their bullish trends as long as those tech giants don’t stumble. The DIA, on the other hand, is beginning to show some technical damage falling below the uptrend and putting in a lower high. So the question to be answered today is will the bulls defend the DIA 50-day average as support? With Jobless Claims and an ECB decision just around the corner, your guess is as good as mine. There is no reason to be running for the doors just yet, but caution flags are flying as market internals continue to raise uncertainty.

Trade Wisely,

Doug

Comments are closed.