Did you ever play with spinning tops as a child? Simple but amusing, these tiny toys have existed since antiquity. If they’re spun precisely and very quickly, they remain balanced on their tips due to inertia. In the world of Japanese candlesticks, spinning tops were the inspiration for the naming of the Spinning Top candlestick pattern. Similar in shape to its toy counterpart, with a short body and two long wicks, the Spinning Top is a common but important candlestick signal. To learn more about this unostentatious candlestick, please scroll down . . .

Spinning Top Candlestick Pattern

Formation

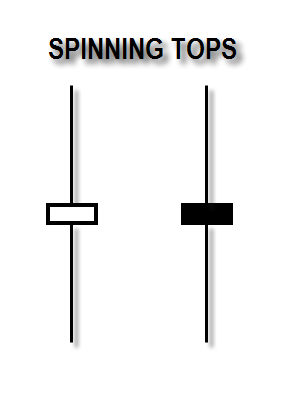

In its simplicity and prevalence, the Spinning Top resembles the Doji. Both patterns feature a single candlestick with a long wick extending from the top as well as the bottom. However, it’s easy to distinguish between the two because one has a body (the Spinning Top) and the other doesn’t (the Doji). So if you’re looking to identify a Spinning Top candlestick pattern, seek out a single candlestick with a short body between two long wicks. The color of the body is not important.

That’s all. Really, it’s that simple. The big question is: what does it mean?

Meaning

When you think of the Spinning Top candlestick pattern, think of a top toy. When it’s spinning smoothly, you can’t say when it will fall and which way it will point. Similarly, a Spinning Top candlestick pattern represents indecision. During the time period represented, neither the buyers nor the sellers had control. As we can see in the short body of the candlestick, the market hasn’t changed much since it opened. However, we can also see that during the specified time period, the buyers and the sellers both had the upper hand at one point or another, as conveyed by the long upper and lower wicks.

If you spot a Spinning Top after an uptrend or a downtrend, it may signal that a reversal is on the way. The rush of buying or selling is paused for a moment of indecision (represented by the Spinning Top), and that lost momentum could signal that the market has changed its tune.

– – – – –

Spotting a Spinning Top candlestick pattern isn’t difficult. Because it is neither bearish nor bullish but simply neutral, it appears in both uptrends and downtrends. Although both the buyers and the sellers have failed to gain control, they’ve been playing tug-of-war and both sides had the advantage at one time or another during the specified period. Due to this indecision and uncertainty, it is hard to know where the market will head next. Until you have a clearer picture, be careful and don’t make any rash decisions. Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.