All that pushing and shoving by the tech giants finally got the job done as the S&P 500 broke out joining the DIA and QQQ with nothing but blue sky above. Unfortunately, the IWM does not benefit from big tech and continues to lag way behind the other indexes still in a short-term downtrend. That said with a light day on the earnings and economic calendars I would expect the fear of missing out trade to push indexes higher. However, keep in mind that the Thursday GDP and Friday Core PCE nears, bullish momentum could fade into some uncertainty ahead of the data.

Overnight Asian markets traded mixed with Japan hitting 33-year highs as China led the selling down 2.68%. European markets started the week off bullishly mostly green following the Friday surge higher. U.S. futures also point to bullishness wanting to extend the Friday break out with the tech titans leading the way with great anticipation of their pending earnings.

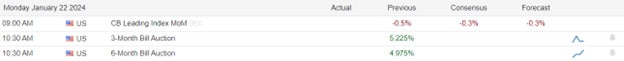

Economic Calendar

Earnings Calendar

Notable reports for Monday include AGYS, AGNC, BRO, IBTX, TFII, UAL, & ZION.

News & Technicals’

Buy now, pay later, a service that allows online shoppers to split their purchases into interest-free installments, boosted online sales to a new high during the holiday season, growing by 14% compared to the previous year. However, many consumers are facing difficulties in paying off their bills, as they are already burdened by record-high credit card debt and rising delinquency rates. The frequency of buy now, pay later defaults is not clear, but the users of the service are more prone to miss payments on other credit products, such as car loans or mortgages.

Moody’s Investors Service has a pessimistic view of the credit quality of APAC countries in 2024, as China’s economic growth decelerates and funding and geopolitical challenges increase. The credit rating agency said that China’s growth slowdown has a large impact on APAC economies, as they are closely linked to China’s role in global trade. It also said that the global liquidity situation, which depends on the Fed’s policy stance, is another factor that affects the credit outlook. The agency expects the Fed to keep its policy tight until the middle of the year, which could limit the availability of funds for APAC countries.

The new year has brought more job losses for many workers, even as the economic indicators show signs of improvement. Inflation has eased, unemployment has fallen, and recession fears have faded, but many big companies are still downsizing their workforce. However, the layoff strategies vary among different companies. Some companies are opting for a one-time, large-scale cut, while others are preferring a gradual, phased-out approach. The reasons for these different methods may depend on the company’s financial situation, industry outlook, and employee morale.

The stock market closed with a huge surge, as the S&P 500 broke out and finally reached a new all-time high joining the DIA and QQQ. However, the IWM continues to lag substantially behind without the benefit of the tech giants. The technology sector was the best performer, with semiconductor stocks boosting the sector after Taiwan Semiconductor Manufacturing Corp. (TSMC), a major chipmaker, posted better-than-expected results, and its shares jumped more than 6%. Today we have a very light economic calendar with a few notable reports but I would expect the fear of missing out on trade to continue this upside breakout at least until we get the next reading on the GDP on Thursday morning. Stay with the trend and enjoy the ride but keep in mind that valuations are very frothy so watch for hints of trouble along the path.

Trade Wisely,

Doug

Comments are closed.