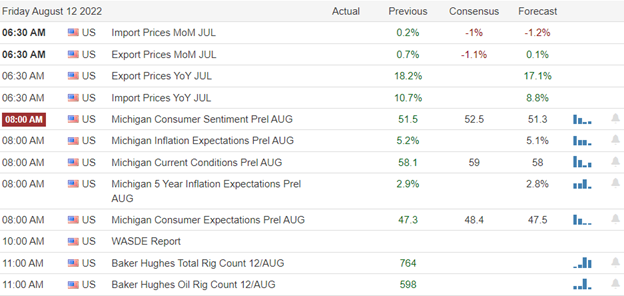

The improved CPI and PPI reports produced significant morning gaps but produced little to no buying follow-through momentumless low-volume chop. However, there is no question that the bulls are in control and own the current uptrend. Yesterday’s bearish topping candle patterns may be of no consequence because they also lacked conviction, and the overnight futures are already pumping for another gap up open. With a light day for earnings, inspiration traders may look to the Import/Export and Consumer Sentiment reports to keep the party going into the weekend.

Asian markets closed Friday mixed through the Nikkei bounced back up 2.62% by the end of trading. European markets trade with modest gains, cautious about future monetary policy and global growth concerns. However, with a light day of earnings U.S. point to another gap up ahead of economic reports. So, expect a push to close the week bullish but don’t rule out another pop and drop if the reports cannot generate some follow-though momentum in this short-term extended condition.

Economic Calendar

Earnings Calendar

Though we have about 60 companies listed on the earnings calendar for today, many of them are very small-cap or unconfirmed. Notable reports include BR, HNST & SPB.

News & Technicals’

According to market strategists, the Federal Reserve is unlikely to pivot from its hawkish interest rate hikes despite positive signs this week that inflation in the U.S. could be easing. As CPI and PPI soften, markets have started to moderate their expectations for Fed rate hikes. But that doesn’t mean it is “mission complete” for the Fed, said Ben Emons, managing director of global macro strategy at Medley Global Advisors. Victoria Fernandez, the chief market strategist at Crossmark Global Investments, said the Fed is nowhere near putting the brakes and turning dovish on rate hikes, given the current data. The chief financial officer of German energy firm RWE said it would burn more coal in the short term — but insists its plans to be carbon neutral in the future remain in place. Greenpeace has described coal as “the dirtiest, most polluting way of producing energy.” “To be very clear, it doesn’t change our strategy,” Michael Muller told CNBC of its carbon neutral plans. Retailers rushed to enter the subscription space, curating boxes of clothing and other items. But consumers are showing signs they’re no longer interested. Trunk Club, which Nordstrom acquired for an undisclosed amount in 2014, no longer exists. Stitch Fix, launched in San Francisco in 2011, is struggling to be profitable. Electric vehicle maker Rivian Automotive maintained its full-year guidance for deliveries Thursday. The automaker reported second-quarter revenue that was higher than Wall Street expected. But it trimmed its full-year financial outlook, saying investors should now expect a wider loss and lower capital expenditures than it had previously forecast. Treasury yields edge lower in early Friday trading, with the 2-year at 3.19%, the 5-year at 2.96%, the 10-year at 2.86%, and the 30-year at 3.13%. The 12-month bond remains inverted over the 2, 5,10,30-year bonds trading at 3.20%.

Though the CPI and the PPI generated significant morning gaps, the rest of Wednesday and Thursday lacked momentum in low-volume-chop. Yesterday produced a pop and drop but of very little significance as volume ruled the day, and the T2122 indicator barely budged from its extreme overbought condition. The premarket pump is already working for another morning gap up, so the bearish topping candle patterns left behind on Thursday may mean nothing with the bullish desire to hold this run into the weekend. Today we get readings on Import/Export prices and will take the temperature of the consumer with a look at their sentiment. With the bulk of the earnings season behind us, traders will have to weigh the overall results within a rising rate environment with weakening world economic conditions as we slide into fall.

Trade Wisely,

Doug

Comments are closed.