Today the market may breathe a sigh of relief with the bond market closed for Columbus Day, providing a break from the rising yields. Unfortunately, with no earnings or economic reports today, we could see a choppy day as we wait for the inflation reports and the kick-off of the 4th quarter silly season. The hopefulness of the so-called Fed pivot fell apart on Friday with the strong jobs report suggesting another 75 basis point increase is possible. Watch for earnings warnings and possible downgrades as the economic challenges continue.

Asian markets fell across the board during the night, with tech stocks taking the biggest hit due to the new U.S. chip regulations. European markets traded in a choppy session this morning with flat to slightly bearish results. U. S. futures recovered substantially from overnight losses, but at the time of this report suggests an uncertain and flat open. Expect choppy price action and a sensitivity to the news cycle as we hurry up and wait.

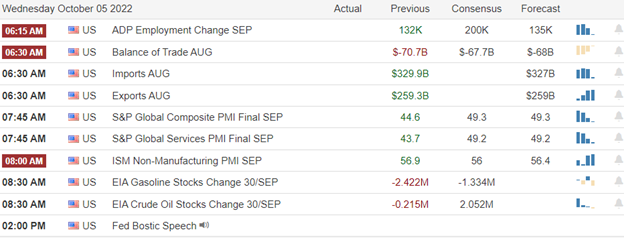

Economic Calendar

Earnings Calendar

Although we have eight companies listed on the Monday earnings calendar, there are no confirmed reports today.

News & Technicals’

The U.S. announced Friday that new U.S. rules require companies to apply for a license if they want to sell certain advanced computing semiconductors or related manufacturing equipment to China. Notably, the changes also mean foreign companies will need a license if they use American tools to produce specific high-end chips for sale to China. “The U.S. has been abusing export control measures to block and hobble Chinese enterprises wantonly,” the Chinese Ministry of Foreign Affairs Spokesperson said.

Allianz Chief Economic Adviser Mohamed El-Erian said he predicts headline inflation “will probably come down to about 8%,” but that core inflation “is still going up.” El-Erian said an increase in core inflation means “we still have an inflation issue.” On Monday, the Bank of England announced that it would introduce further measures to ensure an “orderly end” to its purchase scheme on October 14. Following last month’s unprecedented spike in gilt yields, LDIs — which hold substantial quantities of gilts and are owned predominantly by final salary pension schemes — were receiving margin calls from lenders.

The bears could breathe a sigh of relief today because the bond market is closed for Columbus Day, which aided the Friday selling as yields surged. However, the challenging price volatility will remain due to the uncertainty of the 4th quarter earnings season beginning Thursday, FOMC minutes, a CPI, PPI, and retail sale report. Moreover, the narrative of a Fed pivot that created last week’s nasty whipsaw hurt a lot of speculation retail bounce traders. It may soon usher in a capitulation event if earnings begin to disappoint and fear turns to panic. That said, be ready for big price swings but stay focused and follow the trend because there will be plenty of opportunities to profit.

Trade Wisely,

Doug

Comments are closed.