Index prices drifted sideways in a choppy market session as the market struggles with momentum waiting on jobs data. The big question of the morning is, will the data inspire the bulls, or will it bring out the bears? Anything is possible, and the market has proven it’s not shy about making huge moves, so plan your risk accordingly. Keep in mind we still have the Employment Situation number to deal with before the market open on Friday. Stay focused and flexible!

Asian markets traded mixed overnight, with Hong Kong selling off 1.13%. European markets trade decidedly bearish this morning in reaction to Chinese data. Ahead of a big day of earnings and economic data, the U.S. futures currently point to a bearish open, but in truth, anything is possible as the data rolls out. Buckle up it could be a wild ride!

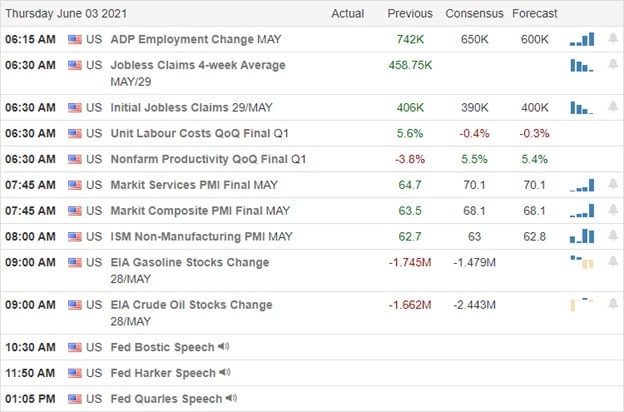

Economic Calendar

Earnings Calendar

We have our busiest day this week, with 24 companies on the earnings calendar. Notable reports include ASAN, AVGO, CEIN, CRWD, DOCU, DLTH, EXPR, FIVE, SJM, JOAN, LULU, MDB, SCWX, WORK, SUMO, TLYS, & ZUMZ.

News & Technicals’

The frenzy of meme-stock traders nearly doubled the share price of AMC on Wednesday, with more than 70 million shares traded. The stock is up more than 2800% year to date as this dangerous activity continues to draw the attention of regulators. Analysts suggest oil prices continue to rise this summer as economies around the world reopen. Demand in the U.S. has begun to draw down reserves built during the pandemic, with $80 per barrel or higher expected targets. Russia is warning this morning that its economy is showing signs of overheating as consumer inflation accelerated again in May to top the 5.5% reading in April. Treasury yields traded mixed this morning ahead of private payrolls and jobless claims data. The 10-year rose to 1.5926% as the 30-year dipped to 2.2774%.

The price activity in the indexes drifted sideways yesterday in a choppy session as the market continues to struggle with momentum. On the good side, the bearish activity on Tuesday found no followthrough sellers holding as price supports. That said, we still have overhead resistance in all the index charts, and the possible double top pattern in the SPY and weakness in big tech remains a concern. Today, we face our biggest day of earings coupled with several possible market-moving economic reports that could provide inspiration. The question yet to be answered is will that inspiration favor the bulls or the bears? Premaket futures are currently under pressure suggesting a bearish open, but anything is possible as the market reacts to jobs data.

Trade Wisely,

Doug

Comments are closed.