Uncertainty continues as the government shutdown begins a new week with little to no progress. As a matter of fact, the President seemed only to reinforce his position with a flurry of border security tweets this weekend. On the positive side, there seems to be a renewed energy between the US and China to resolve the trade war. Let’s hope for a positive outcome soon!

Futures are currently pointing to a flat open which is something we’ve not seen for a long time. A nice change in my humble opinion. A quiet consolidation would be nice, but I suspect the market will remain very sensitive to political news and volatility remains high. After a 750 point rally on Friday, don’t rule out the possibility of some profit-taking. I would also not be that surprised to see a test of the overnight high in the futures. Stay flexible and prepared for quick reversals on political news and as always stay focused on price.

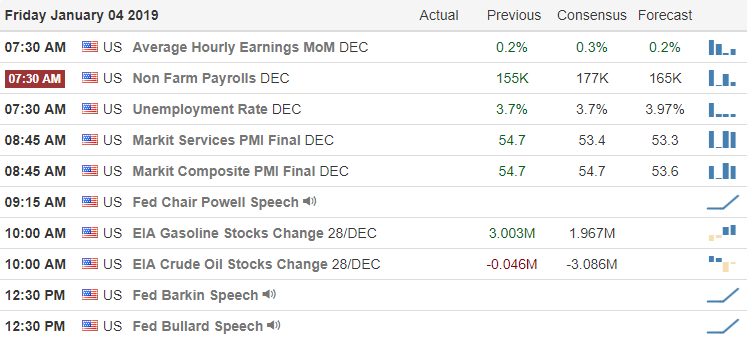

On the Calendar

On the Earnings Calendar, there are 12 companies reporting earnings today, but there are none particularly notable.

Action Plan

US futures opened trading very positive and at one point suggested a bullish move of more than 150 points. However, having sold off during the evening, we could experience some we’ve not seen for a long time, a flat open to the market. I must say a nice change if that does occur! US / China trade negotiations seem on track this morning, and both sides appear to more inclined to complete the process. Unfortunately, there is still on progress on the government shutdown and the President seemed to dig in his heels with a flurry of tweets on border security this weekend.

Although there is still significant political uncertainty, the market on Friday seemed to issue a vote of confidence rallying more than 750 points. I would expect the market to stay very sensitive to political news with fast moves that could easily reverse direction intraday. Don’t rule out the possibility of some profit taking today nor the possibility of testing the overnight futures highs. The current market condition continues to favor day trading but a flat open today could finally signal that the market is trying to settle its nerves. As always stay focused on price action and remain flexible.

Trade wisely,

Doug

Comments are closed.