The bulls triggered a tremendous short squeeze rally yesterday as this all-or-nothing emotional market flips sentiment as quickly as turning a light on and off! What happens next as we ramp earnings is anyone’s guess while the WHO warns of another global pandemic wave on the way. So be careful as we approach price resistance levels as traders rush back into this high-risk price action environment. Don’t rule out the possibility of a pop and drop from this short-term extended condition.

Overnight Asian markets traded mixed with modest gains and loss in reaction to the U.S. bullishness. European markets are decidedly bullish this morning, citing solid earnings as travel stocks soar 4%. Ahead of earnings data, the bulls are looking to extend yesterday’s gains. So, fasten that seat belt tight as this rollercoaster ride of enormous price swings continues.

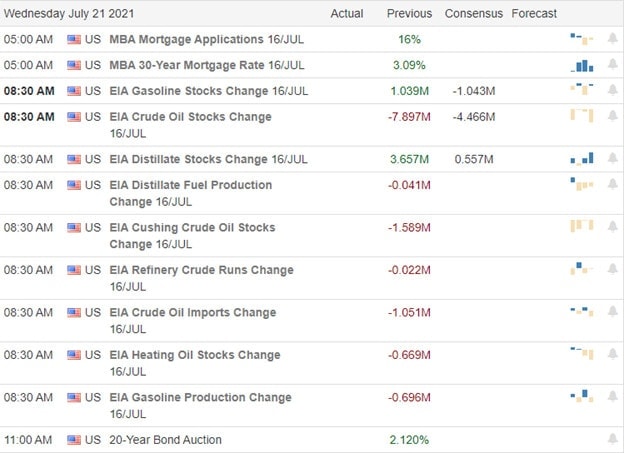

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have nearly 70 companies listed as the earnings season ramps up. Notable reports include JNJ, ANTM, ASML, KO, CMA, CCI, CSK, DFS, EFX, HOG, KMI, KMX, LVS, NDAQ, STX, FTI, THC, TXN, VZ, & WHR.

News & Technicals’

The WHO is warning this morning that the world is going into the early stages of another wave of Covid while addressing the International Olympic Committee. Benefiting from the pandemic, JNJ expects to sell $2.5 billion doses of their vaccine worldwide this year. As a result of the pandemic, life expectancy in the U.S. declined for the first time since World War 2. Netflix misses on earnings and expects streaming growth to decline in the coming quarter. To combat the decline, the company will, for the first time, offer gaming as part of the streaming service. Debit in China is becoming a concern as the total number of defaulted corporate bonds grew to 62.59 billion yuan in the first half of this year.

The selloff on Monday was blamed on the fear that the delta variant would impact the market recovery. The news on the front didn’t change overnight, but Tuesday sentiment suddenly shifted again, triggering a tremendous short squeeze rally. It’s all but impossible to matain an edge in this highly emotional everything-or-nothing price volatility and wild speculation. That said, the bulls are without question hungry for risk as we zoom back toward price resistance levels in the index charts. Toss earnings volatility into the mix, and anything is possible. So plan your risk carefully and remember just how quickly market sentiment can shift. The VIX remains elevated, and with the huge swings in the last couple of days, the risk is high, so avoid overtrading and guard against complacency.

Trade Wisely,

Doug

Comments are closed.