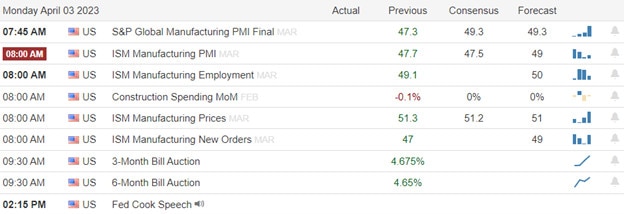

It took until Friday afternoon for the end-of-quarter window dressing activity to finally trigger s short squeeze surging indexes higher into the Friday close. The question now is can they follow through with the uncertainty of 2nd quarter earnings and a T2122 indicator showing an overbought index condition? Surging oil prices will be a help to the bulls after the surprise production cut decision from OPEC this weekend. However, PMI, ISM, and construction spending numbers have recently shown a very weak economic condition the bears may also find inspiration to fight back. Expect some big price moves, and watch for the possibility of quick intraday whips as a new quarter of trading begins.

During the night Asian markets mostly rallied with modest gains with surging oil prices rising costs. Though UBS falls 4% this morning and Europe worries about the rising oil prices their indexes continue to push upward across the board this morning. However, U.S. futures trade mixed this morning with Dow benefiting from the rising oil prices while tech indicates a bearish open with the SP-500 suck somewhere in the middle.

Economic Calendar

Earnings Calendar

We have a very light week on the earnings calendar as we wait for the official kick-off of the 2nd quarter with the big bank earnings beginning April 13th. Notable reports for Monday include AYI, LNN, MSM, RGP, & SGH.

News & Technicals’

Several OPEC+ members have announced intentions to voluntarily cut a further combined 1.16 million barrels per day of production. This move is independent of the broader bloc’s output strategy and will challenge consumer governments, such as the U.S., which are already tackling high inflation and volatility in the banking sector. A formal meeting of an OPEC+ technical committee takes place Monday to review the group’s existing strategy. It cannot change policy. Oil prices soared as much as 8% at the open after OPEC+ announced it was slashing output by 1.16 million barrels per day. The voluntary cuts will start from May to the end of 2023, Saudi Arabia announced, saying it was a “precautionary measure” targeted toward stabilizing the oil market.

Burger chain McDonald’s is temporarily closing its U.S. offices this week as it prepares to inform corporate employees about its layoffs as part of a broader company restructuring. “During the week of April 3, we will communicate key decisions related to roles and staffing levels across the organization,” the Chicago-based company said in the message viewed by The Wall Street Journal. McDonald’s also asked employees to cancel all in-person meetings with vendors and other outside parties at its headquarters. McDonald’s is expected to begin announcing key decisions by Monday.

The end of the quarter finally developed into a short squeeze on Friday afternoon with a strong buying push into the close of the day. At the same time, however, the T2122 indicator reached an overbought condition adding to the question if the bulls will have the energy to follow through with more buying in the Monday market. On the other hand, Goldman suggests this weekend that the institutional CTA’s are overly short and could begin a buying spree this week unless we see a substantial downside move. Adding additional upside pressure was the surprise OPEC decision to cut oil production substantially causing oil prices to surge this morning. That said we still face PMI, SIM, and Construction Spending data that have been very weak economic indicators of late. With lots of job data ending with the employment situation report on Friday traders should prepare for just about anything.

Trade Wisely,

Doug

Comments are closed.