Yesterday’s huge reversal triggered a massive short squeeze forcing those caught short forcing them to buy to cover positions. Those that held their short positions through the night hoping for another reversal will certainly experience more pain this morning with Futures pointing to a trip point gap up at the open. If you are holding long positions, a big Congratulations is in order but remember to take profits because this massive volatility is likely not over.

The Dow gained more than 1400 points in just 2-days! A gap up this morning could easily bring in profit-takers as they avoid the weekend risk. Congress has now adjourned leaving the Federal Government shut down for the rest of the year. With many traders likely planning to extend their New Year’s holiday volume could be lacking on Monday and remember the markets will close on Tuesday. There is a lot to consider when planning your risk heading into this weekend.

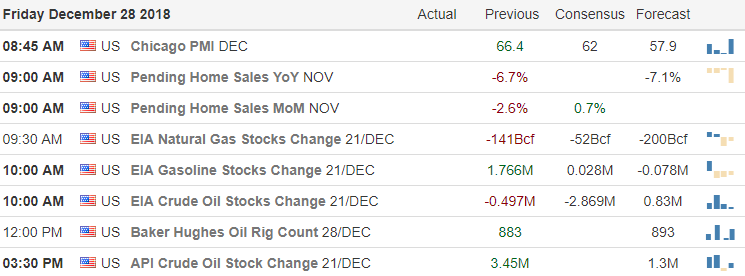

On the Calendar

A light day on the Earnings Calendar with only Eight companies reporting with none that are particularly notable unless you happen to be holding them.

Action Plan

With the Congress now adjourned until next year, it looks as if the Federal Government will remain shut down until sometime next year. We should continue to expect the massive volatility to continue which makes holding positions into he the weekend carry significant risk. US Futures this morning are pointing to a significant gap up follow-through on yesterday’s huge reversal whipsaw that triggered a massive short squeeze. Those that held short positions through the night will be in pain this morning keeping the pressure on the short squeeze, but if you’re holding long positions I would like to remind you that gaps are gifts!

The potential of another reversal whipsaw heading into the weekend is certainly not out of the question so be careful not to allow greed, prevent you from taking profits. Personally, I would like to see a bullish close today but with the extreme volatility and the Dow having gained more than 1400 points in just two days some profit taking to avoid the weekend risk would not be a big surprise. Also, keep in mind that volume on Monday (New Year’s Eve) is likely to drop and price action becomes erratic as traders head out for the holiday. Plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.