After hearing that 6.6 million people filed for unemployment as shell shocked chose to ignore the record-making number and rally after Russia and OPEC agree to cut oil production. This morning we get the Employment Situation number that will only show a partial impact from the outbreak as the full measure of the crisis will not occur until the April report. As we approach another weekend of rising infections, deaths, and layoffs, anything is possible, so plan carefully and protect your capital.

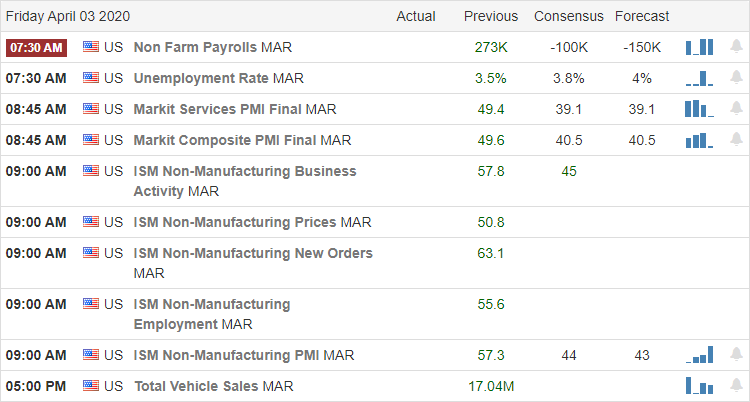

Asian markets closed the week mixed after a record surge in oil prices. European markets are currently showing modest declines across the board as the euro-zone report that business activity fell to new record lows. Ahead of the monthly jobs, number futures point to a gap down, taking back about half of yesterday’s gains. However, we should expect that to get better or worse with very volatile price action as soon as they reveal the numbers. Buckle up!

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have we have just 19 companies reporting quarterly results. Looking through the list, the only particularly notable report is STZ.

Top Stories

The President has invoked wartime measures to compel companies to build much-needed ventilators and masks. New York is already desperately short of this critical breathing equipment, and doctors will soon have to make life and death decisions. As of this morning, more than 245,000 Americans have the infection, and more than 6,000 have died.

Those waiting for their stimulus check may have long wait unless you have filed your taxes online and provided a direct deposit to option for the government. According to reports, those receiving paper checks will have to wait up to 5-months.

Technically Speaking

Traders shrugged off the historic unemployment number, with 6.6 million people applying for benefits. Instead, the market chose to focus on news that Russia and OPEC will cut oil production, reducing the intense downward pricing pressure on the commodity. While this will help the demand destruction created by the corona outbreak is far from over, and surplus supplies will continue to weigh heavily on the prices. Today we will get a reading on the Employment Situation in the US. Although the full impact will not appear until the April report estimates still expect a sharp decline, that could be the worst reading in a decade. How the market might react is anyone’s guess.

Ahead of the Jobs report futures look to give back about half of yesterday’s gain. However, that could change instantly for the better or worse once the number is revealed. As we head into another weekend with viral infections expected to rise and more and more people lose their jobs, it should not be a surprise if sellers pile on to avoid the uncertainty. Protect your capital! The day will come when things start to improve, and there will be an incredible opportunity as long as you haven’t lost your money trading within this extreme volatility. Stay safe; my friends and have a wonderful weekend.

Trade Wisely,

Doug

Comments are closed.