Friday was another big tech-buying party as the sharp rally pushed the SP-500 up 0.9% in just two trading days. With the FRC takeover by JPM as regional bank worries continue, an FOMC rate decision Wednesday, and Apple’s earnings slated for Thursday afternoon expect another week of emotionally charged price swings. Goldman is warning that the CTA’s could be ready to sell off as much as 200 billion of stock holdings. If that occurs expect some big point moves as fear can trigger a rush for the door to protect gains. Buckle up it could be a wild week ahead!

With some Asian markets closed for Labor Day the Nikkei lead the buying by 0.92% with Australia also in a bullish mood. European markets trade mixed but mostly higher this morning with modest gains and losses as banking worries continue. With manufacturing data pending and a slew of earnings U.S. futures trade mixed and flat this morning perhaps suffering from buying hangover after the buying party last week as we wait on the FOMC decision.

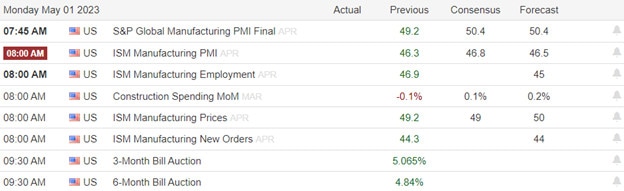

Economic Calendar

Earnings Calendar

Notable reports for Monday include AL, ANET, CAR, CF, CHKP, CHGG, CYH, FANG, RE, FMC, FRWD, BEN, GPN, HOLX, INVH, JJSF, KBR, LEG, LOGI, MSM, MSTR, NCLH, NXPI, ON, OTTR, PK, SOFI, SBAC, SFM, SYK, RIG, VRTX, VICI, VNO, & ZI.

News & Technicals’

JPMorgan Chase, the largest bank in the US, has acquired First Republic Bank, the fourth bank to fail this year, in a deal brokered by the Federal Deposit Insurance Corporation (FDIC). The deal will allow JPMorgan to assume all the deposits and most of the assets of First Republic, which had about $229 billion in total assets and $104 billion in total deposits as of April 13, 2023. First Republic’s 84 offices in eight states will reopen as branches of JPMorgan today. The FDIC said the deal avoids the agency having to use its emergency powers and minimizes disruptions for customers and loan borrowers. The takeover follows the collapse of Silicon Valley Bank and Signature Bank in March, which sparked fears of a wider banking crisis.

Charlie Munger, the vice chairman of Berkshire Hathaway and a legendary investor, has sounded a warning on the U.S. commercial property market, which he said is facing trouble due to bad loans and falling prices. Munger told the Financial Times that U.S. banks have made many risky loans to commercial property owners, such as office buildings and shopping centers, that may not be able to repay them as the demand for such properties declines amid the pandemic and changing consumer habits. Munger said that while the situation is not as bad as the 2008 financial crisis, it still poses a threat to the stability of the banking system and the economy. He also said that Berkshire Hathaway has been cautious about investing in banks because of these uncertainties.

The indexes continued their sharp rally on Friday, with the SP-500 adding 0.8% to its 2.0% surge on Thursday and ending the week with a 0.9% gain. Amazon’s warning of slowing growth in its cloud-computing segment was no match for hungry bulls willing to buy up the tech giants seemly at any cost. First Republic Bank, which plunged 49% on Friday and 95% for the week was taken over by JPM in a deal late Sunday yet more regional banks suffering massive outflows are still in question. Today trades face a possible hangover from Friday’s buying party as well as PMI, ISM, Construction Spending, and a slew of earnings reports. The FED’s May rate decision comes Wednesday afternoon and next tech giant Apple will report Thursday afternoon this week so plan on price volatility as we wait.

Trade Wisely,

Doug

Comments are closed.