Friday’s market was light and choppy as investors seemed to rest after seven straight weeks of buying pushing equity charts into parabolic patterns. That said, there is still nothing in the price action that would suggest the bears are waking up but we should not be surprised if profit-taking begins at any time. With light earnings an economic calendar and the gap up open suggested in the futures market watch for the possibility of a pop-and-drop as Asian and European markets pull back slightly.

Overnight Asian markets mostly declined with only South Korea squeaking out a positive close on defense sector gains. European markets trade mostly in the red this morning with only the FTSE higher after five straight weeks of gains. U.S. Futures, however, wants to keep the buying party going into the new week but after seven consecutive weeks of gains and a holiday just around the corner profit-taking could begin at any time.

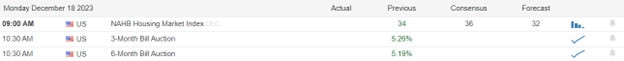

Economic Calendar

Earnings Calendar

The only notable report for Monday is HEI.

News & Technicals’

Nippon Steel, the largest steelmaker in Japan, is eyeing to acquire United States Steel, the second-largest steel producer in the U.S., in a deal that could be worth more than 1 trillion yen ($7.01 billion), according to the Nikkei newspaper. The report, which was published on Monday, did not receive any confirmation from Nippon Steel, as its spokesperson refused to comment on the matter. The report said that Nippon Steel views the U.S. as a promising market that can compensate for the shrinking demand in Japan, where the population and the economy are aging. The report also said that Nippon Steel intends to make U.S. Steel a fully owned subsidiary, as part of its global expansion strategy.

Southwest Airlines, the largest domestic carrier in the U.S., agreed to pay a $35 million fine and a $140 million settlement to end a federal probe into its massive flight disruptions in December 2022. The airline had canceled thousands of flights and left more than 2 million travelers stranded over the holidays, due to a combination of bad weather, staffing shortages, and operational issues. The settlement will mostly be used to reimburse future passengers, as the U.S. Department of Transportation wants to encourage Southwest to prevent such chaos from happening again. The government said that this was the biggest penalty it has ever levied on an airline for breaking consumer protection laws.

The former head of the Federal Deposit Insurance Corporation (FDIC), Sheila Bair, has warned that the Fed is fueling a false sense of optimism in the markets by signaling possible rate cuts in 2024. Bair, who oversaw the FDIC during the worst financial crisis since the Great Depression, criticized Fed Chair Jerome Powell for being too soft on inflation and fostering a climate of “irrational exuberance” among investors. She argued that the Fed should focus more on keeping inflation under control, rather than stimulating the economy with lower interest rates.

The equity markets mostly chopped on Friday perhaps needing a rest as after seven straight weeks of rally producing parabolic patterns but no sign of the bears or profit-takers stepping up just yet. Small-cap stocks outperformed the rest, surging over 5% this week and about 11% in December, as investors became more hopeful about the economic recovery, and a Fed rate pivot next year. Interest rates held steady Friday, as bond yields held near July lows. Today we have a very light day of data with only one notable earnings report coming after the bell and the Housing Market Index report on the economic calendar. Traders should bear in mind with Christmas next Monday volume could begin to quickly decline by mid-week as folks extend holiday vacations.

Trade Wisely,

Doug

Comments are closed.