The bulls look ready to begin September by setting new records at the open to follow seven straight months of gains. With bonds rising this morning, we turn our attention to private payroll and manufacturing numbers for inspiration. However, the supreme court overturning the eviction moratorium and the end of unemployment bonuses on Sept. 6th could create some uncertainty and volatile price action as we progress through the month. Until then, stay with the trend but guard against complacency.

During the night, Asian markets rallied despite the Chinese factory activity shrank in August. Likewise, European markets trade green across the board this morning unconcerned about inflation data that showed consumer prices increased by 3%. Ahead of jobs and MFG. Data U.S. futures continue to march higher, suggesting new records are possible in the SPY and QQQ to kick off September trading.

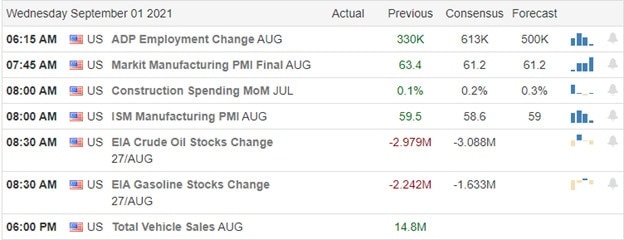

Economic Calendar

Earnings Calendar

We have 21 companies listed on the Wednesday earnings calendar with several unconfirmed reports. Notable reports include ASAN, CHPT, CHWY, CPB, CONN, FIVE, NTNX, RYAN, SMTC, SWBI, VEEV, & VRA.

News and Technicals’

After seven straight months of gains, the bulls appear willing to push for more records as big tech continues to dominate. Historically September is a challenging month for the market, but that has not been true for three of the last five years. With growing evidence that the economy is slowing, the supreme overturning of the eviction moratorium, and the end of unemployment bonuses on Sept. 6th, there is undoubtedly a reason for uncertainty. Then on Sept. 22nd, the FOMC will show its hand for the taper of the easy money policies. Treasury Yields traded higher this morning, with the 10-year climbing to 1.327% and the 30-year rising to 1.945% as we slide into the last month of 3rd quarter trading.

The bulls run will now turn its attention to Private payroll and manufacturing numbers, with the Employment Situation report looming Friday morning. Though internals hint of an economic slowdown, the index chart technicals show no evidence of concern as the bulls power forward, suggesting tech could set more records at the open today. The VIX hinted at a bit of uncertainty rising slightly yesterday, but the slow, choppy price action showed no sign of panic yesterday. The only concern is that the SPY and QQQ are very stretched in the short term, but with the market seeming unconcerned about the extreme valuations, I’m not sure that currently matters. However, complacency is becoming a concern, so guard against overtrading and have a plan to protect yourself should the tide finally decide to go out.

Trade Wisely,

Doug

Comments are closed.