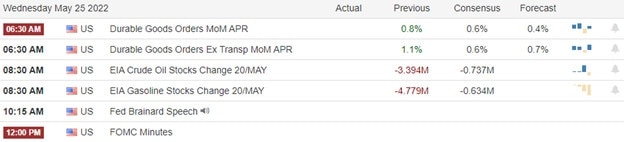

Another day and another big whipsaw as the Dow bounced back from more than a 500-point loss to squeak out a second day of gains. Unfortunately, the SPY, QQQ, and IWM did not enjoy the same bullish result closing lower on the day though well off intraday lows. Today we have Durable Goods, Petroleum Status, the FOMC minutes, and the potentially market-moving report from NVDA after the bell. Remember Thursday; we have another nail bitter with a reading on GDP to keep traders on edge and price action volatile.

Asian markets traded mixed overnight after the New Zealand central bank raised interest rates again to curb inflation. Across the pond, European markets show modest gains this morning, trying to recover slightly from Tuesday’s selling. As we wait on the Durable goods, report Mortgage applications continue to decline with futures retreat from overnight highs currently suggesting a lower open. That could suddenly get better or worse as soon as the number comes out. Buckle up for another day where anything is possible!

Economic Calendar

Earnings Calendar

We have just over 30 companies listed on the Wednesday earnings calendar with only about 20 confirmed reports. Notable reports include NVDA, BOX, DKS, DY, ENS, EXPR, MOD, NTNX, PLAB, SPLK, VSAT, WSM & ZTO.

News & Technicals’

Russia may now create a historic debt default. Up until Wednesday, the U.S. Treasury Department had granted a key exemption to sanctions on Russia’s central bank that allowed it to process payments to bondholders in dollars through the U.S. and international banks on a case-by-case basis. However, the Treasury Department’s Office of Foreign Assets Control has allowed the exemption to expire as of 12:01 a.m. ET on Wednesday, it was announced in a bulletin Tuesday. Adam Solowsky, a partner in the Financial Industry Group at global law firm Reed Smith, told CNBC on Friday that Moscow will likely argue that it is not in default since payment was made impossible, despite having the funds available. According to a filing, Trian Partners, the largest shareholder of Wendy’s, is exploring a potential deal with the company. Along with its partners, Trian owns a 19.4% stake in the burger chain. According to the filing, the hedge fund said it was seeking a deal to “enhance shareholder value” that could include an acquisition or merger. In addition, Georgia’s Republican Gov. Brian Kemp was projected to win his party’s nomination for reelection. Kemp is projected to defeat ex-President Donald Trump’s preferred candidate, former Sen. David Perdue. Kemp will face Democrat Stacey Abrams in a rematch of the gubernatorial contest she narrowly lost to him in 2018, NBC News projected. Treasury yields little changed in early Wednesday trading, with the 10-year traded flat at 2.75% and the 30-year dipped slightly to 2.96%.

The Dow managed to squeak out a second day of gains whipsawing up from an early 500-point loss. However, the SPY, QQQ, and IWM remained lower on the day despite the significant late-day rally. Before the bell today, we get a reading on Durable Goods Orders that consensus estimates suggest a decline. That should not be a surprise given the overall market condition, but the market seems to be holding its breath this morning, hoping the decline is not enough to inspire more selling! After that, we will deal with petroleum numbers, more Fed speaks, the FOMC minutes, and a potential market-moving report from NVDA. If that’s not enough drama to deal with, remember we have a GDP reading before the bell on Thursday. Anything is possible, so stay focused on price action and avoid overtrading in a likely day of uncertainty and volatility.

Trade Wisely,

Doug

Comments are closed.