Increased saber-rattling over the weekend as Iran and the US exchange threats and tensions grow between the countries. Not surprisingly, markets around the world are reacting negatively to the growing uncertainty. With little on earnings or economic calendar to provide market inspiration, the news spin cycle will affect market sentiment and price action volatility. Traders will have to stay nimble and focused carefully on price action for clues. As of the close on Friday, index trends and support held as the bulls stepped up to defend after the morning gap down. Unfortunately, we face a similar bearish gap this morning.

Asian markets closed in the red across the board as oil prices jumped more than 2%. European indexes are also trading negatively this morning as they monitor the growing tensions between Iran and the US. Futures this morning here in the US point to a substantial gap down open this morning to begin our first full trading week this year. Geopolitical events can create extreme shifts in sentiment as news comes out. Plan your risk accordingly.

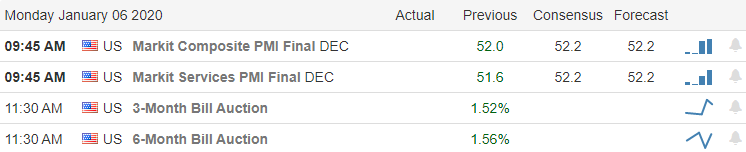

On the Calendar

On the Monday earnings calendar, we have just 4 companies reporting, but none are notable and unlikely to any overall market effect.

Action Plan

With little on the economic and earnings calendar today, the market will likely focus on the Iranian tensions and any news developments on the subject. Over the weekend, Iran voted to expel the US from the country and threats were made against the US troops to be removed by force. The President responded, saying the troops would remain right where they are unless Iran pays back the American people for the expensive and newly created base. He also threatened sanctions like the country had never seen before.

In response to the Iranian threat of retaliation, the President said the US has picked out 52 targets if they do. Now the House, which is upset they were not briefed on the Iranian airstrike, are trying to move forward a bill this week that would attempt to limit Presidental powers. As you might imagine, markets around the world continue to react negatively to the saber-rattling and the uncertainty it creates. As of the close on Friday, the bullish trend remained in tack and bulls had successfully defended price support levels. Futures this morning reflect the worry of the market pointing to a substantial gap down at the open to begin our first full week of trading in 2020.

Trade Wisely,

Doug

Comments are closed.