Yesterday indexes finished mixed as the Russell 2000 surged higher hinting at a possible rotation for the high-flying tech sector to small-cap names. The afternoon selling raised some caution leaving behind some shooting star patterns on the Nasdaq and SP-500 charts with VIX moving higher diverging from the overall market. Of course, this action was not a surprise with all eyes on the CPI data pending and the uncertainty that brings to the minds of traders. We also have a big day of earnings reports so I think it’s fair to say that anything is possible today. Stay with the trend but continue to raise your stops in case the bears find a reason to attack because big-point moves are possible.

Overnight with many Asian markets still closed, the Nikkei touched 38,000 and nears an all-time high. However, European markets trade lower across the board this morning with cautiousness as they wait on U.S. inflation data. U.S. futures also suggest a lower open as we wait on the CPI data that could move the market substantially in either direction. Buckle up it could be a wild and price action morning.

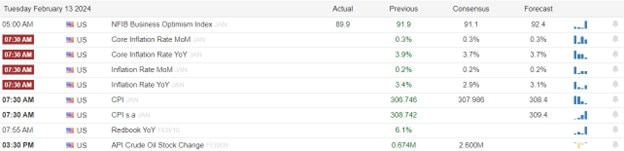

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include ABNB, AKAM, ALC, AIG, ANGI, AN, BIIB, KO, CRK, CRSR, DDOG, DVA, DENN, ECL, WIRE, ENTG, EWT, FELE, GFS, DGGY, GXO, HAS, HE, HRI, HWM, IAC, INCY, CART, INVH, KTOS, DON’T, LDOS, LYFT. MAR, MGM, TAP, MCO, PAAS, PRI, QSR, HOOD, SITM, STAG, MODG, TPG, TRU, UPST, WXO, WELL, WCC, KLG, ZG, & ZTS.

News & Technicals’

JetBlue Airways, a low-cost airline based in New York, is facing pressure from activist investor Carl Icahn, who disclosed a 9.9% stake in the company on Monday. Icahn believes that JetBlue is undervalued and has the potential to grow its market share and profitability. He has expressed his interest in joining the board of directors and influencing the company’s strategy and governance. JetBlue, which has been struggling to recover from the pandemic and the failed merger with Spirit Airlines, has been implementing cost-cutting measures and operational improvements to boost its performance and competitiveness.

Nvidia, a leading chipmaker and technology company, has seen its stock price soar to record highs, sparking fear of missing out (FOMO) among investors. According to Julian Emanuel, a senior managing director at Evercore ISI, many of his clients, who have experienced the dot-com bubble and burst, are more concerned about not having enough exposure to Nvidia than having too much. He said this is the first time he has seen this sentiment since 2021, which he views as a warning sign. He also expects a 13% correction in the stock market this year, which he thinks is normal in a non-recessionary environment.

The perception of China and Russia as threats to the West has decreased in the past year, according to a new survey that reveals the growing awareness of non-conventional risks. The survey, conducted among G7 countries, shows that mass migration caused by war or climate change and the spread of radical Islam are now the most feared risks among Western populations. The survey also indicates that most Westerners expect China and the Global South to gain more influence and power in the next ten years, while the West will face stagnation or decline.

The stock market was mixed on Monday, with the S&P 500 falling slightly, while the Dow added about 120 points and the Russell 2000 surged higher, gaining about 2%. The best-performing sectors were energy, utilities, and materials, while information technology and consumer discretionary trailed behind. Treasury yields were stable, with the 10-year yield ending around 4.17%. Oil prices did not change much, closing at about $77 a barrel. This morning the Small Business Optimism Index missed expectations showing a decline disappointing the market sending premarket futures lower. Before the market opens the Inflation data will be the main focus for markets, with the CPI report, and could create significant price volatility considering the very extended condition of the indexes. Beyond that, we have a large number of earnings that will keep traders gambling on the next big mover. Buckle up anything seems possible today.

Trade Wisely,

Doug

Comments are closed.