Index charts started the day making lower lows as the 10-year bond topped 5% but as it began to ease markets whipsawed higher and whipped again to finish a rough day mostly lower. After the bell today we will begin the tech giant reports with the highly anticipated GOOGL and MSFT results. Expect some wild price action as traders and investors react from this extreme short-term oversold market condition. Buckle up the earnings over the next ten trading days could determine market direction for the rest of the year.

Asian markets recovered from early losses to close the day with modest gains with only Hong Kong slightly lower. European markets trade cautiously higher after disappointing results from Barclays while waiting on an important manufacturing report. U.S. futures push higher this morning as earnings roll out pondering the pending big tech reports after the bell. Anything is possible so plan your risk carefully.

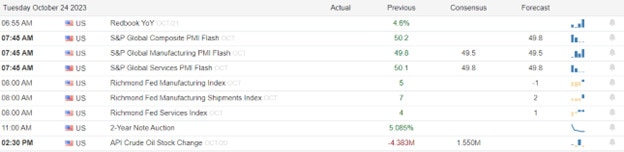

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include ADM, ARCC, ABG, BYD, CNI, CNC, KO, CB, GLW, DHR, DOV, DOW, WIRE, FFIV, FI, FELE, GE, GOOGL, GM, HAL, HA, ITW, IVZ, JBT, KMB, MMM, MSFT, MTDR, NEE, NEP, NUE, ONB, PACR, PACW, PNR, PII, PHM, DGX, RRC, RHI, RTX, SHW, SMPL, SNAP, SPOT, SYF, TECK, TDOC, TXN, TRU, VZ, VICR, V, WM, XRX.

News & Technicals’

Norway’s sovereign wealth fund, the largest in the world, reported a loss of 374 billion Norwegian kroner ($34 billion) in the third quarter of 2021, due to a weaker performance of the stock market. The fund, which is officially called the Government Pension Fund Global, still managed to beat its benchmark index by 0.17 percentage points. The fund’s deputy chief executive, Trond Grande, said in a statement that the third quarter was weaker than the first half of the year when the fund gained 1.4 trillion Norwegian kroner ($126 billion). The fund invests in stocks, bonds, and real estate around the world, and holds about 1.4% of all listed shares globally.

Barclays, the British banking giant, reported a lower-than-expected profit of £1.03 billion for the third quarter of 2021, down from £1.51 billion a year ago. The bank’s CEO, C.S. Venkatakrishnan, said that the bank “continued to manage credit well, remained disciplined on costs, and maintained a strong capital position” despite a “mixed market backdrop.” The bank faced challenges from lower income in its investment banking division and higher provisions for bad loans due to the COVID-19 pandemic. Analysts polled by Reuters had predicted a profit of £1.18 billion for the quarter, which was also lower than the £1.33 billion profit in the second quarter of 2021.

Nvidia and AMD, two of the leading manufacturers of PC chips, are reportedly developing chips that use the Arm-based instruction set, which is different from the x86 instruction set used by Intel’s PC chips. The Arm-based instruction set is more common in smartphones and other mobile devices, as it allows for lower power consumption and longer battery life. According to a Reuters report, Nvidia and AMD are aiming to challenge Intel’s dominance in the PC market by offering more energy-efficient and cost-effective alternatives. The report also said that Nvidia and AMD are working with Microsoft, which has been developing its own Arm-based PC operating system and software.

The indexes had a rough day whipsawing as they eyed the 10-year Treasury yield and pondered the pending and highly anticipated tech giant reports. The yield reached above 5.0% in the morning but retreated to around 4.85% by the end of the day. The sharp rise in government bond yields has caused more fluctuations in both stocks and bonds. Higher yields can also affect the economy and the markets in various ways, such as by raising borrowing costs, lowering stock valuations, and reducing the bond price returns. China’s banking system is also in crisis according to a Bloomberg report as money flees the country adding worries of global economic instability. Today we have a barrage of earnings events that include the market movers of GOOGL and MSFT after the bell. The economic calendar is light with a PMI composite, Richmond Fed Mfg., and a 2-year bond auction to inspire. Expect considerable price volatility and perhaps a short squeeze IF the data supports a relief rally from this extreme short-term oversold condition. In fact, the next ten trading days could set the direction for the rest of the year so plan carefully.

Trade Wisely,

Doug

Comments are closed.