Yesterday’s big morning gap lost buying energy almost immediately as resistance won the day. Though the price action left behind bearish engulfing, dark cloud cover patterns and a possible double top on the SPY price supports also proved to hold. Is there a reason for concern? Yes, but there is also no reason to believe the sky is falling. A follow-through down today could become very concerning but should the bulls find inspiration in the jobs data holding on to price supports, the uncertainty may shift to those holding short positions. Stay focused as anything is possible.

Overnight Asian markets traded mixed but mostly lower as Australia’s GDP came in stronger than expected. European markets trade modestly bullish this morning near record highs. U.S. futures are once again pumping the open ahead of the ADP jobs data. What happens next is anyone’s guess, so keep a sharp focus on price action, support, and resistance levels for clues.

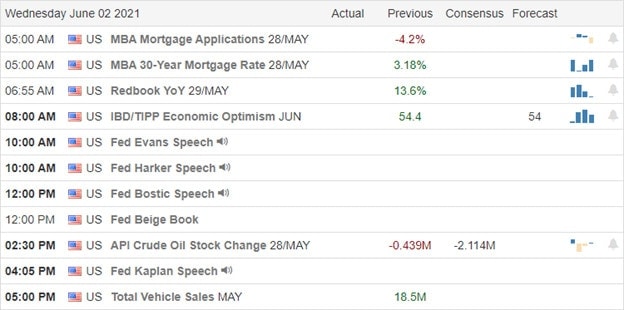

Economic Calendar

Earnings Calendar

The Wednesday earnings calendar lists 19 companies reporting, with several as unconfirmed. Notable reports include AAP, CLDR, LE, NTAP, PVH, & SPLK.

News & Technicals’

According to Fed official William Dudley, the recent spike in U.S. inflation is “likely transitory for now, but could become more persistent in the coming years.” That kind of like saying you’re a bit pregnant but plan for the next few years to be a lot of work! Ahead of the private payroll jobs data, treasuries ticked slightly lower to 1.606% on the 10-year and 2.288% for the 30-year yields. Economists look for private payrolls to improve over the April reading at 266,000 to 674,000 in May. ZOOM reports blowout earnings but now sees a 50% revenue growth for the full fiscal year but warns of a coming slowdown. ZM stock price is little changed this morning. Amazon has set its big summer sales event, Prime Day, for June 21 and 22.

Yesterday proved to be a bit disappointing after the overly rambunctious morning gap that was stopped in its tracks by price resistance. I think you would have to say that resistance won the day leaving behind some concerning bearish candle patterns and a possible double top on the SPY. However, it was not that bad if you consider the overall chart and the fact that price supports held by the close of the day. What will be very important is how price action follows though today! Should price move on lower today, confirming the bearish engulfing and dark cloud cover patterns, that’s a more serious concern. If today the price action holds price support, we may still have a reason for caution, but odds of new record highs improve. A lot will depend on the market reaction to the Private Payroll numbers released before the bell. Buckle up; anything is possible.

Trade Wisely,

Doug

Comments are closed.