As the country begins the process of reopening the economy, the bulls and bears are grappling with what the new normal will look like as the battle with the virus continues. So many questions, so much uncertainty, and the realization that the recovery will be very complicated until a vaccine becomes widely available will test investor’s resolve. Add to that massive week of earnings reports, and the stage is set for a week of whipsaws and big morning gaps.

Asian markets closed the day mixed but mostly lower, with Hong Kong dropping more than 4%. European markets are decidedly bearish this morning down more than 3% as US-China tensions rise over coronavirus. US Futures have rallied off of overnight lows but still point to a Dow gap down or 200 to 250 points challenging it’s 50-day moving averages as support. Prepare for another hectic week.

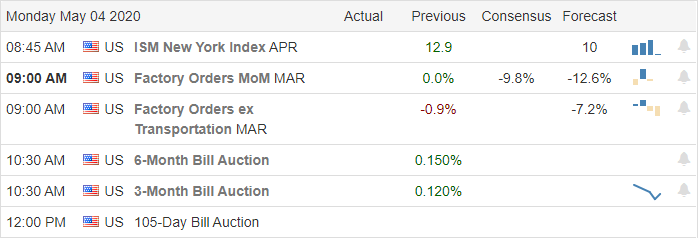

Economic Calendar

Earnings Calendar

We have a hectic week of earnings reports. The Monday calendar indicates more than 250 companies will report today. Notable reports include O, AIG, AWR, CAR, CRUS, DLB, EXPE, HTZ, L, NNN, OHI, PETS, SRE, SHAK, SWKS, TXRH, TSN, WMB, and WH.

Technically Speaking

The question as to whether the market will follow-through to the downside seems answered with futures pointing to a substantial gap down open. Now the question on everyone’s mind, will the 50-day moving averages serve as support? If not, then we will have to rely on some key price supports to stop the selling. The DIA support at about 232 looks the most vulnerable, with SPY having a bit more cushion around 275. As the country begins to process of reopening the market is struggling with what the new normal may look like and will we be able to control the spread of the virus enough to not overwhelm the healthcare system. With social distancing rules still in effect, can businesses even afford to open with lower volumes of consumer traffic?

Airlines are in decline this morning after learning that Berkshire Hathaway sold its entire stake in the industry due to the coronavirus impacts. Not a big surprise when the Oracle of Omaha loses confidence in the industry sector. With a massive week on the earnings calendar with around 1500 companies reporting, we should prepare for another volatile week of price action. Intra-day whipsaws and significant overnight gaps remain likely and will prove challenging to navigate. A week later than usual, the Employment Situation report on Friday could have a substantial influence on this week’s activity. If the consensus estimates are anywhere close to correct, it’s going to be a difficult pill to swallow and harder to ignore than the weekly unemployment numbers.

Trade Wisely,

Doug

Comments are closed.