The Thursday gap up raised the hope that a relief rally may finally begin once again disappointed with a bearish reversal that now threatens a test of Monday’s low. After the solid earnings performance from APPL, overnight futures rallied, but they have also reversed, suggesting a lower open this morning. Though internals suggest a short-term oversold condition, a relief rally may be tough to come by with mixed earnings results, a hawkish Fed, and the growing concerns of a Russian invasion as we head toward the weekend. Moreover, earnings numbers intensify next week so expect the volatility to keep traders on edge as February approaches.

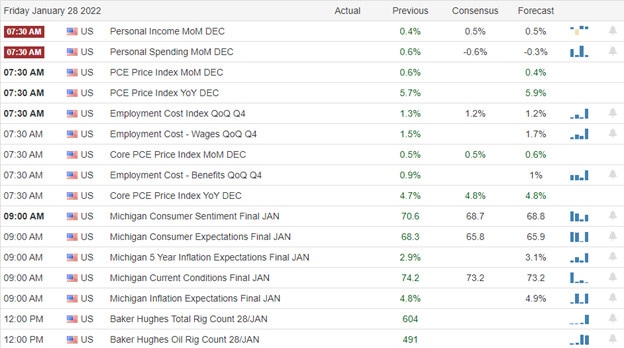

Asian markets ended the trading week with a volatile session as the real estate crisis intensified in China. This morning, European markets trade decidedly bearish, seeing red across the board lead by the DAX down more than 2%. Likewise, U.S. futures reversed overnight bullish to suggest a bearish open with Personal Income and Consumer Sentiment data on the horizon.

Economic Calendar

Earnings Calendar

We get a little break on the number of earnings on Friday with less than 60 companies listed and a good number of them unconfirmed. Notable reports include CVX, ALV, BAH, CAT, CHTR, CHD, CL, RDY, GNTX, LYB, PSX, SYF, WY, & WETF.

News & Technicals’

Apple reported its largest single quarter in revenue ever, with sales growing over 11% despite supply challenges and the lingering effects of the pandemic. In addition, Apple beat analyst estimates for sales in every product category except iPads. Apple CEO Tim Cook said that the company’s supply issues were improving. Apple CEO Tim Cook said the company is seeing inflationary pressure in an interview with CNBC’s Julia Boorstin on Thursday. The observation from the Apple CEO comes as the Biden administration and Federal Reserve grapple with questions about how to tame elevated inflation. Robinhood anticipates first-quarter revenue of less than $340 million, down 35% compared with 2021. According to FactSet, Wall Street expected $448.2 million in revenue for Q1. Monthly active users fell to 17.3 million last quarter from 18.9 million in the third quarter. Robinhood is about to face its toughest comps in the first and second quarters of 2022, following its record year in 2021 from events like the GameStop short squeeze. According to CB Insights, tech start-ups raised a record $621 billion in venture capital funding globally in 2021. However, some VC investors worry the boom times may not last much longer as tech stocks fall amid talk of higher interest rates. VCs say they’re already hearing about deals renegotiated at lower valuations and even withdrawal of term sheets. Treasury yields rose slightly in early Friday trading, with the 10-year trading at 1.8266% and the 30-year climbing to 2.1126%.

On Thursday, the wild week continued with another huge point bearish reversal that provided early hope that a relief rally might begin. Now, rather than a relief rally, the selling poses the possibility that the low on Monday could receive another test. As we chop around near the recent lows, the index 50-day moving averages have turned lower, technical overhead resistance levels and hinting of a possible death cross in the weeks ahead if the selling pressure continues. Market internals continue to suggest and shot-term oversold condition, but with a hawkish Fed and the growing concern of a Russian invasion, that’s a big question as we slide toward the weekend. Although we have a lighter day on the earnings calendar, we have economic reports that could provide early session volatility. So as you plan for next week, keep in mind that earnings numbers continue to intensify and will likely keep us guessing with overnight reversals and intraday whipsaws.

Trade Wisely,

Doug

Comments are closed.