After Friday’s ugly selloff, the relief rally to fill the bearish gap was a nice reprieve. The SPY and IWM recovered nicely, closing above their 50-day averages, while the DIA remains the weakest index with substantial overhead resistance yet to overcome. Speculation and emotion are running high, as evidenced by the back-to-back 600 point swings. The wild price action favors day traders but makes it near to impossible to have an edge as a swing or position trader. Be very careful chasing buys as we test overhead price resistance levels that may have entrenched bears willing to defend.

Overnight Asian mostly rallied, with the NIKKEI leading the way, surging 3.12% through the HSI continued to drift south. European market trade mixed this morning with modest gains and losses as trade inflation and interest rate fluctuations. Ahead of a light earnings calendar and Housing numbers around the corner, U.S. futures have bounced off overnight lows but currently point to a flat open. After yesterday’s big relief rally, a little rest is not out of the question.

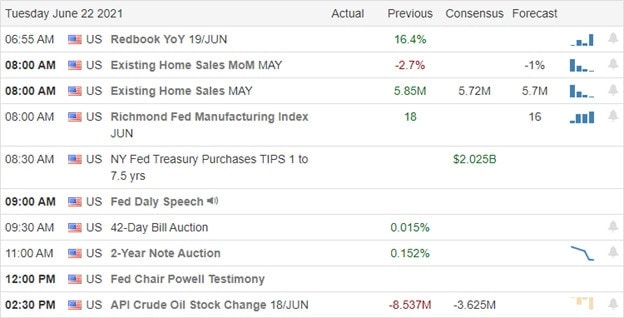

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have just eight companies listed, with only half verified. Notable reports include KFY and PLUG.

News & Technical’s

The assault on the big tech’s continue with European Commission opened an antitrust investigation into Google. According to the report, the probe is looking into the advertising unit that has made it harder for rival online advertising services to compete. China’s illegalization of nongovernmental sanctioned cryptocurrencies has taken a toll on Bitcoin that has lost $300 billion in value since last Friday. Chinese authorities in the Sichuan province ordered crypto miners to shut down operations, and the Bank of China urged financial institutions not to provide crypto services. Fed Chairman Jerome Powell said in testimony prepared for delivery to Congress that the economy is growing, but faces continued threats from the Covid pandemic. He said inflation has risen “notably” but repeated his position that the price pressures are transitory. He has a story, and he’s sticking to it! The 10-year treasuries yields increased slightly this morning to 1.501%, and the 30-year advanced to 2.115%.

Yesterday’s relief rally filled the bearish gap left behind in Friday’s price action in the DIA, SPY, and IWM. The DIA remains the worst technical condition remaining below its 50-average with substantial overhead price resistance yet to overcome. However, the SPY and IWM recovered their 50-day averages but still have to price resistance levels above to yet to overcome. The SPY remains in a bullish trend even as semiconductor stocks suffered a pullback due to the China crypto mining crackdown. I wouldn’t call the 600 point swings in the last two days trading days healthy price action. In fact, it’s difficult to impossible for swing and position traders to have an edge in this kind of trading environment. Big price swings and high volatility favor the day trader. As the index charts approach price resistance levels, be prepared for the possibility of bearish pushback. Expect price volatility to remain high, with large intraday whipsaws and overnight reversals possible.

Trade Wisely,

Doug

Comments are closed.