On Monday, the Dow diverged from the broader market, achieving both intraday and closing record highs. This movement contrasted with a decline in tech stocks and gains in less favored segments like energy, suggesting a potential shift in investor focus away from one of the market’s key drivers over the past year. Investors are particularly keen to see the upcoming earnings report from Nvidia, a major beneficiary of the artificial intelligence boom, scheduled for Wednesday. Additionally, the market is digesting the latest Case-Shiller House Price Index and Consumer Confidence report results released this morning.

European markets saw a modest increase, driven by gains in mining stocks amid hopes for rate cuts. Copper prices reached a near-six-week high, contributing to a 0.9% rise in mining stocks. The automotive sector also performed well, with a 0.96% gain. However, not all sectors shared in the positive momentum, as retail stocks traded in negative territory. Additionally, the final reading of the second-quarter gross domestic product showed a 0.1% decline from the previous quarter, aligning with preliminary estimates.

Asia-Pacific markets experienced a downturn, mirroring the overnight declines in the S&P 500 and Nasdaq. Despite this, China reported a positive economic indicator with industrial profits rising by 3.6% year-on-year from January to July. Meanwhile, the Middle East tensions contributed to a surge in oil prices. U.S. West Texas Intermediate crude saw a significant increase of 3.5%, closing at $77.42 per barrel, while Brent crude rose by 3.05% to $81.43 per barrel, marking its highest level in approximately two weeks.

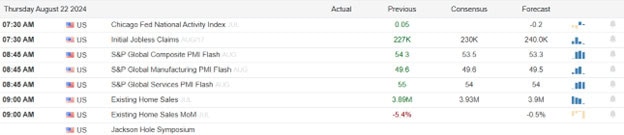

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include AMWD, BNS, HAIN, & SCSC. After the bell include AMBA, BOX, NCNO, JWN, PVH, SMTC, S, & MDRX.

News & Technicals’

Amazon aggregators Branded and Heyday are set to merge this week, forming a new entity named “Essor,” as confirmed by CNBC. This merger comes at a challenging time for Amazon aggregator space, which has struggled since the flow of venture capital funding diminished. Many companies in this sector have faced difficulties in profitably managing the brands they acquired, making this consolidation a strategic move to potentially stabilize and strengthen their operations.

Big Tech companies such as Microsoft, Alphabet, and Meta are pouring billions into data center infrastructure to bolster generative AI capabilities. However, this rapid expansion has significantly increased energy demands. In response, Sustainable Metal Cloud has introduced an immersion cooling technology that is 28% cheaper to install compared to other liquid-based solutions and can reduce energy consumption by up to 50%. According to Tim Rosenfield, co-founder and co-CEO of Sustainable Metal Cloud, this technology supports high-density GPU hosting, which is essential for platforms like Nvidia’s Grace Blackwell.

Rein believes that the panic surrounding PDD Holdings’ recent performance was exaggerated and sees the current situation as a buying opportunity for investors. This perspective follows a significant drop in PDD Holdings’ shares, which plummeted 28.57% on Monday—their largest single-day loss since the company’s Nasdaq listing. The sharp decline was triggered by the company’s failure to meet expectations in its second-quarter results.

Apple announced on Monday that it will appoint Kevan Parekh, currently the vice president of financial planning and analysis, as the new Chief Financial Officer effective January 1. Luca Maestri, who has served as Apple’s CFO since 2014, will transition to leading teams focused on IT, security, and real estate development. This leadership change marks a significant shift within Apple’s executive team as the company continues to evolve its strategic priorities.

While the Dow reached out and closed at a new record high the price patterns left behind on the charts suggests a little caution may be in order. That said, we could see a market just resting and waiting for the highly anticipated report from NVDA after the bell on Wednesday. Expect just about anything as this tech behemoth reports amid all the AI hype the market continues to generate.

Trade Wisely,

Doug

Comments are closed.