Stock futures dipped on Wednesday, following record-high closes for the S&P 500 and Dow, which rose by 0.25% and 0.20%, respectively. The Nasdaq Composite also saw gains, increasing by 0.56% and nearing its record high, now less than 4% away. Despite these positive movements, concerns about a slowing economy persist, especially after the Federal Reserve’s rate cut last week. Investors are now looking ahead to upcoming economic data, including new home sales for August, set to be released on Wednesday morning, and weekly jobless claims on Thursday.

European stocks edged lower on Wednesday, trimming gains from the previous session that were driven by Chinese stimulus measures. The banking sector was notably affected, with the banking index falling by approximately 0.4% as investors closely watched UniCredit’s potential acquisition of Commerzbank, Germany’s second-largest lender. Additionally, German software giant SAP saw a significant drop, landing at the bottom of the Stoxx 600, following reports from Bloomberg that the company is under investigation in the U.S. for alleged price-fixing.

China’s stock market led the Asia-Pacific region on Wednesday, driven by new stimulus measures announced by Beijing the previous day. This positive sentiment also saw the offshore yuan briefly strengthen to 6.995 against the U.S. dollar, marking the first time it broke the 7.00 level since May 2023. Hong Kong’s Hang Seng index reflected this optimism, rising by 0.63% in its final trading hour. Meanwhile, investors turned their attention to Australia’s inflation data, which showed a 2.7% year-on-year increase in the consumer price index for August.

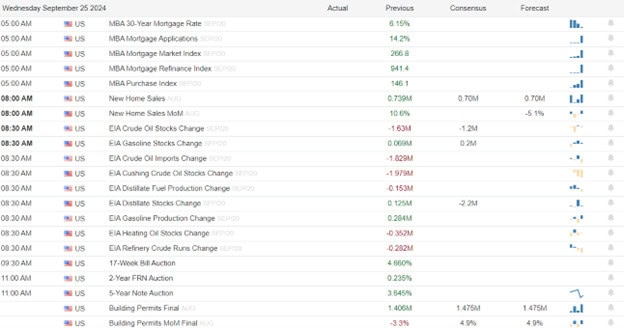

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell notable report includes CTAS. After the bell includes MU, CNXC, FUL, JEF, & WS.

News & Technicals’

Caroline Ellison, the key witness in the case against FTX founder Sam Bankman-Fried, was sentenced to two years in prison by a New York federal court in Manhattan. She was also ordered to forfeit $11 billion. Ellison, who managed the Alameda Research hedge fund linked to FTX, had agreed to a plea deal in December 2022, shortly after the cryptocurrency exchange declared bankruptcy. During sentencing, Judge Lewis Kaplan acknowledged her significant cooperation but stated he could not grant her a “literal get-out-of-jail-free card.”

The Biden administration has endorsed the latest government funding proposal, reducing the likelihood of a shutdown before the November 5 presidential election. House Speaker Mike Johnson, R-La., introduced a new three-month funding bill on Sunday after his initial proposal failed in the GOP-controlled House. This appropriations bill aims to fund the government through December 20, instead of March 2025, and notably excludes the SAVE Act, a contentious voter ID bill.

Italy’s UniCredit has surprised German authorities with a potential multibillion-euro merger involving Frankfurt-based Commerzbank. Market observers indicated to CNBC on Tuesday that this move might have caused a sense of national embarrassment for Germany’s government. Some argue that the outcome of this takeover attempt could challenge the essence of the European project. On Monday, Milan-based UniCredit announced it had increased its stake in Commerzbank to approximately 21% and has requested to raise this holding to up to 29.9%.

Japan has been facing a rice shortage in recent months, driven by a combination of adverse weather conditions and a surge in tourism. This situation has been exacerbated by Japan’s restrictive rice policies. In August, many supermarkets frequently ran out of white rice, prompting stores to limit purchases to one bag per person.

After another round of record-high closes futures suggest a bit softer open for Wednesday. Uncertainty of 4th quarter earnings and the pending GDP and core PCE numbers are a natural reason for choppy price action and weaker than average volume. With the T2122 indicator continuing to register a short-term overbought condition avoid overtrading and have a plan to protect positions if a profit-taking wave begins.

Trade Wisely,

Doug

Comments are closed.