This morning, US equity futures experienced fluctuations as investors took a breather from a record-breaking rally. Despite this pause, Bitcoin surged past $100,000 following President-elect Donald Trump’s appointment of a crypto advocate as the next head of the Securities and Exchange Commission. The S&P 500 marked its 56th record close of 2024, with the Dow and QQQ also reaching new highs, largely driven by gains in big tech. Federal Reserve Chairman Jerome Powell noted that the risks from the labor market had diminished, allowing Fed officials to cautiously lower interest rates toward a neutral level that neither stimulates nor restrains economic growth.

European stocks saw an uptick, particularly in France, following the ousting of Prime Minister Michel Barnier’s government in a no-confidence vote the previous day. The market’s positive movement was driven by gains in travel and banking stocks, although industrials and health care sectors experienced minor losses. In a significant development, Shell and Norway’s Equinor announced their intention to merge their British offshore oil and gas assets, forming a new energy company based in Aberdeen, Scotland. This merger is poised to make the new entity the largest independent producer in the U.K. North Sea.

Asia-Pacific markets showed mixed performance amid significant political upheaval. In South Korea, lawmakers moved to impeach President Yoon Suk Yeol just a day after he declared martial law, with a vote scheduled for Saturday evening, according to local reports. This political instability contributed to a 0.90% drop in the Kospi and a 0.92% decline in the Kosdaq. Meanwhile, Australia’s S&P/ASX 200 saw a modest gain of 0.1%, Japan’s Nikkei 225 rose by 0.30%, but Hong Kong’s Hang Seng index fell by 1.1%.

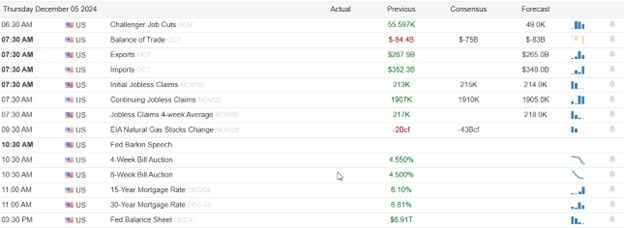

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include CRMT, BMO, BF>B, CAL, CM, DG, GMS, SIG, & TD, After the bell reports include AGX, ASAN, COO, DOCU, COMO, GTLB, GWRE, HCP, HPE, LULU, WOOF, RBBK, IWT, SMAR, SWBI, PATH, ULTA, VEEV, VSCO, & ZIMZ.

News & Technicals’

Wednesday night, Bitcoin’s price surged past the highly anticipated $100,000 mark for the first time ever. This milestone followed new closing records for the S&P 500 and Nasdaq Composite, coinciding with President-elect Trump’s announcement of his SEC chair pick and Fed Chair Jerome Powell’s comparison of Bitcoin to gold. Bitcoin has now risen over 140% in 2024 and 48% since the election. Mike Novogratz, CEO of Galaxy Digital, remarked to CNBC that the digital asset ecosystem is on the verge of becoming a mainstream financial force.

American Eagle has revised its full-year sales forecast downward and provided holiday guidance that fell short of expectations. While the retailer experienced robust demand during the back-to-school season, it noted a slowdown in consumer spending between key shopping periods. Despite this, the Aerie brand continued to perform well, with comparable sales increasing by 5%, building on a 12% rise from the previous year.

Shell and Equinor are set to establish a joint venture in Aberdeen, Scotland, aiming to sustain fossil fuel production and ensure energy security in the U.K. The deal, expected to be finalized by the end of next year pending approvals, will create the U.K. North Sea’s largest independent producer. This strategic move underscores the companies’ commitment to maintaining a stable energy supply while navigating the evolving energy landscape.

Vivek Ramaswamy, co-leading President-elect Trump’s new Department of Government Efficiency alongside Elon Musk, announced that any “last minute spending spree” under Biden’s Inflation Reduction Act (IRA) or CHIPS Act will be closely scrutinized. He specifically mentioned the recent $6.6 billion loan to electric vehicle maker Rivian Automotive. Ramaswamy emphasized that any significant increase in spending and “dollars out the door” during the final days of Biden’s term could be considered “indefensible” and potentially a “fiduciary breach.”

After yesterday’s record-breaking rally futures hint at a possible rest as the bulls catch their breath. However, the index charts all indicate bullish patterns with no signs that the bears gaining ground. That said, the decline in the T2122, T2108, T2107 indicators as the market extends is suggesting a substantial divergence is developing. Should the bears find a reason to attack the divergence could result in a swift and substantial pullback so have a plan in pace to protect capital and profits if those profit-takers find reason to run for the door.

Trade Wisely,

Doug

Comments are closed.