Although health officials are very concerned about the rapid resurgence of coronavirus, the bulls appear ready to continue buying despite the possible impacts. They will have to overcome some bearish engulfing candles printed on Friday and an elevated VIX suggesting that price action will remain quite volatile. Though putting on a brave face this morning, I suspect the market will be quite sensitive to virus news so focused and ready for possible whipsaws and reversals.

Asian markets closed modestly lower overnight, and European markets are whipsawing this morning and currently red across the board as they monitor the coronavirus surge in the US. Here in the US Future point to a bullish open but have pulled back from morning highs as the bulls trying to say; virus, we don’t care about no stinking virus! I guess if can beat it will just try to ignore it, as we hope for more government stimulus.

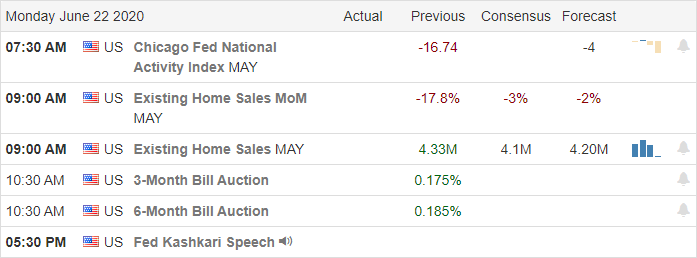

Economic Calendar

Earnings Calendar

On Monday’s earnings calendar, we have just 11 companies fessing up to quarterly results. Notable reports include JKS and TTM.

Technically Speaking

During the weekend, the US saw surging coronavirus infections topping more than 30,000 on Saturday and Sunday. Health officials are concerned that some states could see a sharp rise this week, but as of now, the market appears completely unconcerned as US Futures rise. China announced it would suspend imports of poultry as a result of the Tyson plant coronavirus concerns. Airlines that have been bleeding money due to the pandemic have plans to expand flights in June and July and say they believe they will back to normal by the end of the year. There is concern spreading that it may be challenging to have a college football season this year as more and more players are becoming infected. On Friday, AAPL touched new record highs but triggered an afternoon selloff when they announced the closure of several stores in states where the virus is rapidly spreading.

The DIA left behind a bearish engulfing candle by Friday’s close, failing once again at the 200-day average. IWM also seems to be struggling near its 200-average but managed to hold above Thursday’s low. The SPY printed a bearish engulfing pattern while maintaining a stronger technical pattern, and the QQQ continues to lead the markets holding near record highs. I must admit to a bit of surprise that bulls seem oblivious to the spreading virus as they once again point to a gap up at the open. The VIX remains quite elevated, closing above a 35 handle on Friday, so expect the volatile price action to continue and sensitivity to virus-related news.

Trade Wisley,

Doug

Comments are closed.