Thursday morning’s early bullishness turned to the bear’s favor with yesterday’s pop and drop, leaving behind concerning price patterns on the SPY, QQQ, and IWM. Today with little inspiration available on the earnings and economic calendars, the quadruple witching could add to the wild price gyrations as we slide into the weekend. That could make it challenging for the bulls to defend price supports if traders and investors reduce or avoid weekend risk. Remember, cash is a position!

During the night, Asian markets closed red across the board, with tech stocks sliding south. This morning, European market trade is mainly in the red market, and infection rates, surges, and tech fall 1.7%. This morning, U.S. futures point lower across the board as uncertainty raises its ugly head heading into the weekend. Plan your risk carefully with price gyrations expected due to options expiration.

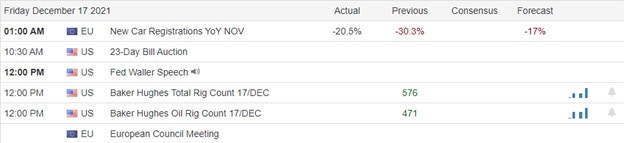

Economic Calendar

Earnings Calendar

We have a very light day on the Friday earnings calendar with just 12 companies listed but only three confirmed. Those listed but not particularly notable are DRI, WGO & YCBD.

News & Technicals’

The Consumer Financial Protection Bureau is seeking information from Affirm, Afterpay, Klarna, PayPal, and Zip on the risks and benefits of their products. For example, “Buy now, pay later” services let shoppers defer payment for items, typically throughout monthly installments and with no interest attached. Affirm’s shares closed down by 11% Thursday, while Australian companies Afterpay, Zip, and Sezzle on Friday dropped 8%, 6%, and 10%, respectively. Rivian said it expects to fall “a few hundred vehicles short” of its 2021 production target of 1,200 vehicles. The company said it faced supply chain issues and challenges ramping up production of the complex batteries that power the vehicles. The updates come alongside Rivian’s first quarterly report as a public company and confirmation of plans for a new $5 billion plant in Georgia that’s expected to come online in 2024. Adobe’s guidance for its fiscal first-quarter badly missed analysts’ estimates. The stock plummeted 10%, its second-worst day in the past decade. In December, it’s the third time that Adobe shares have plunged, putting the stock on pace for its steepest monthly drop since June 2010. Treasury yields dip slightly in early Friday trading, with the 10-year sliding down to 1.4208% and the 30-year declining to 1.8538%.

Yesterday’s pop and drop increased uncertainty, with the QQQ leaving behind a bearish engulfing candle and opening the door for a possible reversal. Today is a quadruple witching day, so the market may experience odd price gyrations as the institutions and investors adjust positions. Unfortunately, we have little to nothing on earnings and economic calendars to inspire direction. That said, with the uncertainty displayed in the charts heading into the weekend, the bulls may have a tough time defending price support levels. Sadly, the hoped-for Santa rally may well succumb to the Grinch’s shenanigans. I wish you all a safe and restful weekend!

Trade Wisley,

Doug

Comments are closed.