Google and Amazon earnings beat expectations, and this morning the QQQ is poised to reach out to new record highs. However, the DIA and SPY lag slightly behind, challenged with overhead price resistance. Facing a big round of earnings and jobs data in focus the rest of the week, expect price action to remain volatile. Should any jobs data disappoint, it would be unwise to rule out another attack from the bears.

Overnight Asian markets closed mixed but modestly bullish. European indexes show mixed but modest gains this morning as the focus remains on earnings results. U.S. futures indicate a mixed open as traders react to morning earnings reports and wait on the ADP private jobs report.

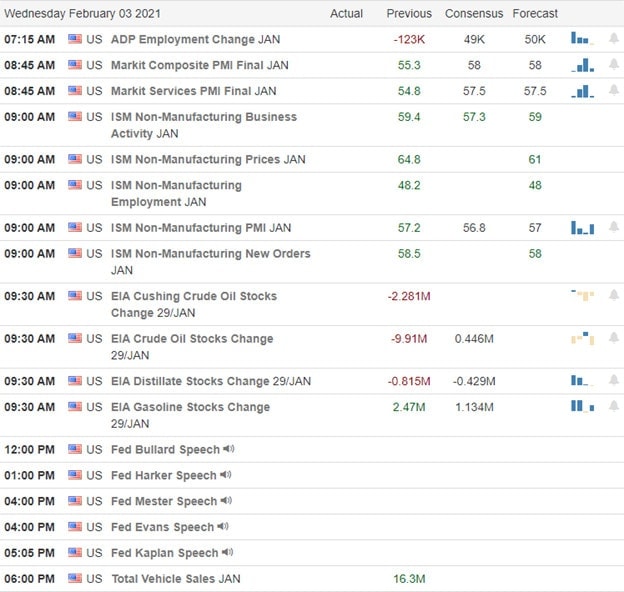

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have nearly 90 companies reporting today. Notable reports include ABBV, AFL, ALGN, ALGT, AFG, APO, AVB, AVY, BIIB, BSX, BIP, CTSH, ELF, EBAY, GSK, GRUB, HUM, IAC, MET, MUSA, NTGR, NVO, PYPL, QCOM, RGLD, SMG, SPOT, VVV, GWW, & YUMC.

News & Technicals’

Markets surged yesterday, with the retail short squeeze frenzy calming as GME fell over 60% on the day. Google surprised the market with better than expected earnings, and Amazon reported its first 100 Billion dollar quarter benefiting from the pandemic restricted holiday shoppers. However, in a surprise move, Jeff Bezos is stepping down as the company CEO in the 3rd quarter of this year to focus his attention on new products. A bit of a big tech battle has emerged between Microsoft and Google. Australia proposed a new law that would force the tech giant to pay news publishers for the right to link to their content. As a result, Google threatened to remove assess to its search engine if the proposal became law.

Interestingly, Microsoft said it would never threaten to leave Australia. I suspect we will hear much more on this subject in the coming months as Google comes under scrutiny for antitrust concerns. Perhaps the next move for Google is stepping up to the Double Dog Dare, LOL.

Yesterday’s substantial rally pushed many stocks up to test resistance levels and elevated the T2122 indicator back into a short-term overbought condition. The test for the bulls now is to prove they have the wherewithal to push through. The QQQ is poised to set new record highs today, with the DIA and SPY still battling price resistance levels. With a slew of earnings reports and jobs data in focus for the remainder of the week, expect the price to remain quite volatile.

Trade Wisely,

Doug

Comments are closed.