The Tuesday market served a classic pump and dump, gapping up at the open, then reversing after the JOLTS number came in hot, adding uncertainty and pressure to the pending Fed decision. The big question is, with the FOMC pause or reduce the speed of increases despite the rising Core PCE number? With the current rally at stake, buckle up for a wild afternoon after the decision is released and the press conference. Adding to the challenging volatility, we have several economic reports and a busy day of earnings reports to keep emotions high. Anything is possible, so plan your risk carefully!

Overnight Asian markets traded mostly higher, led by Hong Kong, which halted trading early due to typhoon warnings. European markets trade mixed and choppy, waiting on the FOMC decision and the Thursday ECB decision that could deliver the most significant trade increase in their history. Facing a big day of market-moving data, the U.S. futures suggest a mixed open as we hurry up and wait on the Fed. Plan for another day of wild price action as the drama unfolds.

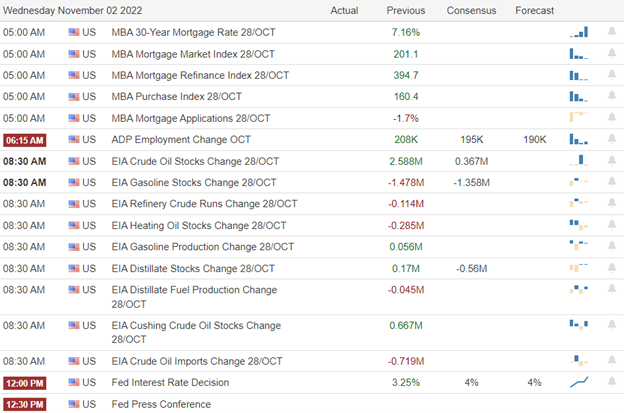

Economic Calendar

Earnings Calendar

Along with the FOMC, we have a big day of earnings reports. Notable reports include ACIW, ALB, ALGT, APO, BKNG, EAT, CHRW, GOOS, CVS, DIN, EBAY, ETR, EL, ETSY, FSLY, RACE, FSR, FTNT, GNRC, TWNK, HUM, IRBT, LL, MRO, MLM, MTTR, MET, MGM, NCLH, NTR, QCOM, O, HOOD, ROKU, RGR, RIG, UAA, & Z.

News & Technicals’

Vice President Kamala Harris plans to announce the new initiative while visiting a sheet metal workers’ training facility and union hall in Boston later Wednesday. HHS will release $4.5 billion in Low Income Home Energy Assistance Program funding, which helps pay energy bills and energy-related home repairs for families. The Biden administration will also provide roughly $9 billion to help low- and moderate-income families lower energy costs by making energy-efficient home upgrades.

Maersk, the Danish shipping giant, is widely seen as a barometer for global trade, reported earnings before interest, tax, depreciation, and amortization (EBITDA) of $10.9 billion for the quarter. CEO Søren Skou said the “exceptional results” were driven by a continued rise in ocean freight rates but said it was clear that these have peaked and will begin to normalize in the fourth quarter.

AMD issued fiscal third-quarter results that missed expectations. In addition, the chipmaker warned about weakening PC sales affecting this quarter’s results in October. Results from all four of AMD’s business segments were better than the company had called in the October announcement. With U.K. inflation running at a 40-year high of 10.1% in September, the Bank is seen hiking its main lending rate for the eighth consecutive time. However, weaker growth momentum and a more conservative fiscal policy are expected to ease the pressure for more aggressive monetary tightening. Goldman Sachs economists lowered their 2023 U.K. growth projections on Monday and expected a split vote in favor of the 75-basis-point hike on Thursday.

Tuesday began with the classic pump and dump, spending the rest of the day in chop as investors pondered the economic conditions with the JOLTS number coming in hot. Although it’s widely expected that the FOMC will raise rates by 75 basis points, the uncertainty is what they will do next! The narrative push around is that they will pause or ease going forward despite the increase seen in the Core PCE. We will find out with the statement at 2 PM Eastern and the chairman’s press conference thirty minutes later. Expect some whippy price action to follow. However, before that, we have Motor Vehicle Sales, Mortgage Applications, ADP, and the EIA numbers with a big day of earnings reports to keep emotion high and price action challenging. So, buckle up for another day where anything is possible!

Trade Wisely,

Doug

Comments are closed.