All the hype and speculation around what the FOMC would do was unleashed yesterday in a dangerous display of price action turbulence as the Dow swung about 900 points from high to low. The massive intraday whipsaw created technical damage in SPY and QQQ as bond yields spiked and the dollar surged higher. Today we face our biggest earnings day this week, as well as several economic reports adding to the uncertainty of the day. Plan for the wild price action to continue as traders and investors sort through the details.

Asian markets had a rough session will selling across the board in reaction to the FOMC decision. In addition, European markets declined across the board this morning, with an ECB rate decision pending. Finally, U.S. futures point to a bearish open ahead of a huge day of earnings and economic data likely to keep emotions and volatility high.

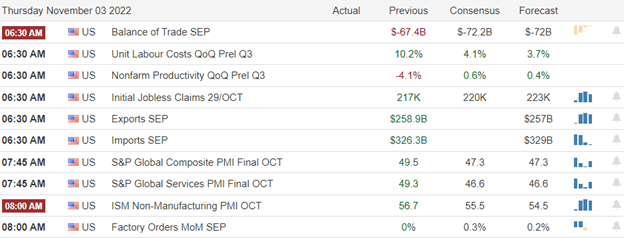

Economic Calendar

Earnings Calendar

Thursday is a hectic day on the earnings calendar, with morning 325 companies listed. Notable reports include ADT, ABC, AMGN, AAWW, GOLD, BCH, SQ, CVNA, LNG, CI, COIN, COP, CROX, CMI, DASH, DBX, LOCO, EOG, EXPE, GPRO, HBI, K, KTOS, MAR, MELI, MRNA, NRG, PZZA, PYPL, PTON, PLNT, SWKS, SBUX, TWLO, W, WWE, & WELP.

News & Technicals’

Pilots and other airline workers are asking for higher pay in new labor deals. However, some recent attempts at deals by the most significant U.S. carriers have fallen flat. As a result, airlines are under pressure to combat a pilot shortage while keeping a lid on costs. Twitter insiders expect a 50% overall reduction in force, representing about 3,700 employees, after Tesla and SpaceX CEO Elon Musk, bought the company last week. According to Bloomberg, musk is expected to require employees once authorized to work remotely to now work out of Twitter offices in and beyond San Francisco. Advisors were planning to meet with Musk on Wednesday night to solidify plans for a major reduction in force. Qualcomm shares fell in extended trading on Wednesday after the chipmaker reported in-line fourth-quarter earnings and a small revenue beat but offered poor first-quarter guidance. According to a statement, the overall revenue grew 22% year over year in the quarter that ended Sept. 25. The company also said it implemented a hiring freeze at the start of the current quarter.

According to official figures, inflation in Turkey rose 85.5% year-on-year in October for the 17th consecutive month as food and energy prices continued to climb. The dramatic rise in living costs for the country of 85 million has continued unabated for nearly two years. Food prices were 99% higher than last year’s period, housing rose by 85%, and transport was up 117%, the Turkish Statistical Institute reported Thursday. A hawkish Fed Chairman, Jerome Powell, vowed to beat inflation and said the central bank might have to raise rates more than expected. That sent stocks lower and bond yields higher, as traders bet the Fed could raise rates above 5% before stopping. However, the Federal Reserve left the door open to reducing the size of rate hikes, as expected.

As suspected, with a highly anticipated FOMC announcement, the price action turbulence was dangerous, with the Dow swinging from nearly 400 up to closing more than 500 points down. Market speculation and emotion are clearly at an extreme level which may make high-frequency trading firms and very experienced day traders happy. Still, it’s a very dangerous market condition for most traders and investors. Moreover, yesterday’s massive intraday whipsaw created technical damage in the SPY and QQQ index charts as price supports failed below their 50-day averages. Though still quite extended, the DIA and IWM were minimal, but the point moves possible to reach a price support could be substantial. If that’s not enough, we have our biggest day of earnings and economic reports this week about to trigger more emotion and uncertainty. Traders should plan for another day of challenging volatility as we head for the Employment Situation number Friday before the bell.

Trade Wisely,

Doug

Comments are closed.