Possible Follow-through?

Bullishness in the Asian and European market has the US Futures suggesting the first possible follow-through rally in nearly a month! Certainly exciting to see but as the indexes challenge price resistance levels, we can’t rule out the possibility of profit-taking. As a result, traders will need to say on their toes focused on price action and aware of the current market volatility.

Bullishness in the Asian and European market has the US Futures suggesting the first possible follow-through rally in nearly a month! Certainly exciting to see but as the indexes challenge price resistance levels, we can’t rule out the possibility of profit-taking. As a result, traders will need to say on their toes focused on price action and aware of the current market volatility.

As earnings continue to roll out this morning, keep in mind that anything is possible. We have recently experienced the pain caused by chasing into a gap up open that ultimately sells off the rest of day. Please understand I’m not hoping for or suggesting that will occur. I’m merely pointing out the possibility and that traders need to remain thoughtful of the risk and prepared for anything this volatile market tosses our way. Have a plan and trade with a stop!

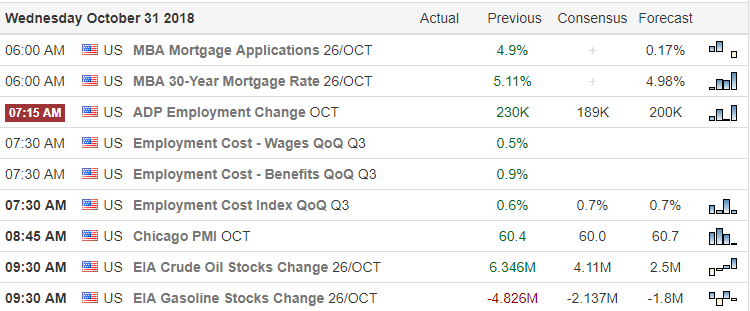

On the Calendar

On the Earnings Calendar, we have over 250 companies reporting earnings today. Among the most notable today: ACGL, ACOR, ADP, AEE, AMGN, ANTM, APC, APO, APTV, BAX, BG, BGS, BHE, BIDU, BJRI, BXP, CAKE, CDW, CG, CHRW, CIM, CLVS, CLX, CONE, CRTO, CVE, CXO, DDD, EA, EBAY, EIX, EL, EPD, ESIO, ETR, EXAS, EXC, EXR, FB, FEYE, FLT, GM, GRMN, H, HCLP, HCP, HES, HFC, HLF, ICE, ICPT, IGT, INN, IQ, K, MDR, MGM, MXIM, MXL, NBR, NCR, NTRI, NUVA, OI, OKE, OMI, ORBC, PAYC, PBF, PDM, PSA, QNST, RDC, RDN, RPAI, RRR, RXN, SC, SEND, SF, SFLY, SITE, SNY, SPR, SPWR, SSW, TAP, TEL, TMHC, TMUS, TTMI, VOYA, VRSK, WEC, WES, WLL, WNC, YUM, YUMC, ZEN

Action Plan

Could we actually get two bullish days in the row? Big gains in Asian markets overnight with European decidedly bullish this morning has US Futures currently suggesting a gap higher of more than 100 points. Unfortunately, with such a big gap, we have to be on guard for the possibility of a pop and drop as the indexes challenge the downtrend and price resistance levels. Consequently, be careful chasing into the morning gap until we see real buying supporting the new level.

Of course with more than 250 companies reporting earnings a lot could change by the open. Continue to plan for high volatility, fast price action, and whipsaws. As the indexes and individual stocks test, upper resistance levels remember to take some profits to the bank.

Trade Wisely,

Doug

Comments are closed.