South Korean stocks surged ahead in the Asia-Pacific region on Tuesday, buoyed by the positive earnings results on Wall Street. The Kospi index, South Korea’s benchmark stock index, soared 2.16% to close at 2,734.36, marking its highest point in over a month. Meanwhile, the Kosdaq, known for its smaller-cap stocks, also enjoyed gains, albeit more modest, finishing 0.66% higher at 871.26. In contrast, the Reserve Bank of Australia maintained a steady course, holding its benchmark lending rate unchanged at 4.35% for the fourth consecutive meeting, signaling a cautious approach amidst global economic shifts.

European markets kicked off Tuesday’s trading session on a high note. The Stoxx 600, a key regional index, witnessed a 0.6% uptick by 9:30 a.m. in London. Leading the charge were financial services, which saw a notable 2.2% increase. A standout performer was the Swiss banking behemoth UBS. This positive financial revelation propelled UBS shares to climb by 8% during the morning trading hours.

U.S. stock futures displayed mixed futures results near the break-even point on Tuesday, with the Dow Jones Industrial Average poised to extend its winning streak to a fifth consecutive day amid a fresh wave of earnings reports. Dow futures edged higher by 70 points, translating to a modest gain of 0.2%. The S&P 500 futures saw a slight increase of 0.1%, reflecting cautious optimism. In contrast, the Nasdaq 100 futures experienced a minor dip, also by 0.1%, suggesting a more reserved stance among tech investors.

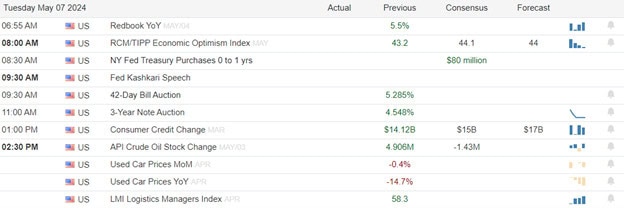

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include DIS, AHCO, APLS, ARMK, AVNT, BLMN, BLDR, CELH, CROX, DDOG, DK, DUK, ENR, NPO, EXPD, FWRG, GFS, GOGO, HR, HSIC HLMN, IONS, J, KVUE, NJR, NRG, OSCR, PRGO, PTLO, ROK, SCSC, SERE, SPR, SQSP, TPX, BLD, TDG, UBS, WAT, WOW, & KLG. After the bell include RDDT, AWR, ANDE, ANGI, ALTM, ANET, AIZ, AGO, ALAB, ASTH, BIO, BL, BHF, CDRE, CRC, CHRD, CRUS, CFLT, CRSR, CPNG, DEI, BROS, EA, FLYW, GMED, GPRO, GO, GXO HALO, IAC, IRBT, JKHY, KTOS, KD, LAZR, LYFT, MGY, MTW, MTCH, MCK, MLNK, MYGN, OXY, LPRO, PCRX, PR, PROS, PUBM, QLYS, RDFN, RVLV, RNG, RIVN, SHLS, SONO, STAA, RGR, TOST, TRIP, TWLO, UPST, VECO, SPCE, WYNN, & ZI.

News & Technicals’

Disney has delivered a commendable financial performance, exceeding earnings estimates while achieving revenue that met analyst projections. In a notable milestone, the company’s streaming services, Disney+ and Hulu, reported a combined profit for the first time in their operational history. However, when accounting for ESPN+, the overall streaming unit faced a setback, incurring a loss of $18 million for the quarter. This contrasted with the downturn in traditional revenue streams, as both TV revenues and box office sales experienced a slump during the same period. The mixed results highlight the shifting landscape of media consumption, with streaming services gaining ground despite challenges, while conventional media formats struggle to maintain their foothold.

UBS has made a remarkable financial turnaround, reporting a significant return to profitability after enduring losses in the previous two quarters. The Swiss financial titan exceeded first-quarter expectations, largely due to a surge in wealth management revenues. Looking ahead, UBS has outlined a strategic roadmap, announcing its anticipation to finalize the merger with Credit Suisse into a unified U.S. intermediate holding company in the upcoming second quarter. Furthermore, the consolidation of its Swiss operations is slated for completion in the third quarter. This ambitious integration reflects UBS’s commitment to streamlining its global operations and fortifying its position in the competitive financial landscape.

Palantir Technologies, the data analytics firm, has delivered a robust financial performance, surpassing revenue expectations and achieving an Earnings Per Share (EPS) that aligns with analyst predictions. However, the company has tempered expectations with its projection of weaker-than-anticipated full-year guidance. Despite this cautious outlook, Palantir has consistently demonstrated profitability, marking its sixth consecutive quarter of net profit. In a significant development, the company secured a lucrative $178 million contract with the U.S. Army. This contract is aimed at advancing the Army’s technological capabilities by developing a state-of-the-art, field-deployable sensor station, which underscores Palantir’s growing influence and integral role in national defense initiatives.

BP, the oil and gas giant, has reported a dip in its first-quarter profits, which stood at $2.7 billion. This decline is primarily attributed to the downturn in oil and gas prices, coupled with a “significantly weaker” fuel margin. The trend of shrinking profits is not isolated to BP; it reflects a broader pattern within the energy industry, where companies are grappling with reduced year-on-year profits, especially impacted by the falling market gas prices. Despite these challenges, BP has reaffirmed its commitment to its shareholders by announcing share buybacks totaling $3.5 billion for the first half of 2024, signaling confidence in its financial strategy and prospects.

The market will be keenly focused and hoping for positive earnings results with little to no inspiration coming from the economic calendar. Expect whipsaws and price volatility as the reacts.

Trade Wisely,

Doug

Comments are closed.