The GS earnings report inspired a big gap open, resulting in another pop-and-drop pattern as the indexes struggled with overhead resistance and a short-term overbought condition. Bond yields relaxed slightly, and the dollar dipped temporally after a coordinated effort by Chinese banks to bolster the Yuan. However, this morning bond yields rebounded as recession fears rise ahead of the pending housing data. As earnings work to inspire the bulls to rally, the worries over inflation, rising rates, recession, and slowing global economies are likely to keep the bears engaged and price action challenging.

Asian markets traded mixed but mostly lower overnight, with the tech-heavy HSI falling 2.38%. European markets trade flat to modestly bullish after the UK inflation climbed back above a 40-year high. Trying to draw inspiration from earnings reports, U.S. futures struggle to hold on to overnight lows ahead of housing data that may remind the market about recession. Plan carefully and prepare for the wild price volatility to continue.

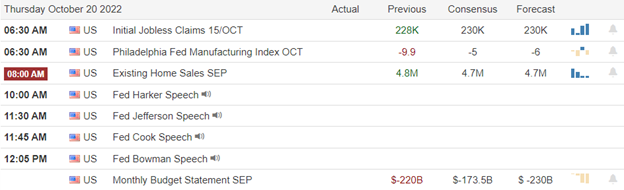

Economic Calendar

Earnings Calendar

The earnings calendar is starting to heat with nearly 50 companies listed and about 40 confirmed reports for today. Notable reports include ABT, AA, ASML, CMA, CCI, EFX, IBM, KMI, LVS, PG, PPG, STLD, TSLA, TRV, & WGO.

News & Technicals’

Netflix beat third-quarter expectations on the top and bottom lines Tuesday. The company added 2.41 million net subscribers during the quarter, higher than the 1 million it had forecast. Netflix will begin to crack down on password sharing next year. ASML reported third-quarter revenue and earnings on Wednesday that topped analyst expectations, bucking the trend of a slowdown seen by other semiconductor firms. Shares of chip firms have been battered this year amid a slowdown in growth among companies like Samsung and Micron as the semiconductor boom hits a wall. But the strong results from ASML bucked the broader market slowdown, sending shares more than 6% higher in morning trade. ASML said that it expects the direct impact of the U.S.’s chip curbs on China to be “limited.”

DOE says the funding opportunity represents the “largest investment in tidal and river current energy technologies in the United States.” Over the past few years, a number of projects related to tidal power have taken big steps forward. While there is excitement about the potential of renewable technologies such as tidal power, there are significant challenges when it comes to scaling up. President Joe Biden will announce the release of up to 15 million more barrels of oil from the Strategic Petroleum Reserve, sources familiar with the plan told CNBC. The move aims to extend the current SPR delivery program through December. In addition, an EU embargo on Russian oil is scheduled to go into effect on Dec. 5.

U.K. inflation rose in September 2022 as the country’s cost-of-living crisis continues to hammer households and businesses ahead of a tough winter. However, inflation unexpectedly dipped to 9.9% in August, down from 10.1% in July, on the back of a fuel price decline. Treasury yields rose across the board on Wednesday as concerns over a recession spread among investors, and markets looked ahead to releasing housing market data. The 6-month bond rose to 4.35%, the 12-month to 4.46%, the 2-year to 4.48%, the 5-year to 4.28%, the 10-year to 4.07%, and the 30-year to 4.07%.

Tuesday served a pop-and-drop price move after a big gap up open inspired by the better-than-expected GS earnings. Chinese currency operations took some pressure off the dollar, lifting the Yuan slightly as bond yields modestly relaxed. Unfortunately, as we stare down the barrel of the Housing Starts and Permits number, fears of recession resurfaced this morning, with bond yields rising along with the dollar. While earnings have provided us with a relief rally, the indexes remain challenged by significant overhead resistance. I expect price volatility to remain high with overnight reversals and intraday whipsaws as inflation, rate increases, and the slowing global economy continue to weigh heavy on investors’ minds.

Trade Wisely,

Doug

Comments are closed.