As it turns out my caution of getting caught up and chasing yesterday gap open proved to be correct, producing a pop and drop pattern at price resistance levels. The President’s tough talk on China trade practices at the UN only emboldened the bears pushing indexes lower with the QQQ suffering the worst of the technical damage unable to hold it’s 50-day average. Adding insult to injury Congress began yet another political drama that’s likely to affect the market well into the future opening an impeachment inquiry of the President.

During the night trade tensions and political uncertainty had Asian markets seeing red across the board at the close of trading. Currently, European markets are of a like mind and decidedly bearish across the board this morning. Not surprisingly US Futures are indicating a lower open for the market but let’s keep an eye on the SPY & DIA key moving average supports for a possible area of defense by the bulls. If they fail to hold as did the QQQ the technical damage could greatly inspire the bears to continue lower. Stay focused and flexible as this news-driven market continues to challenge traders.

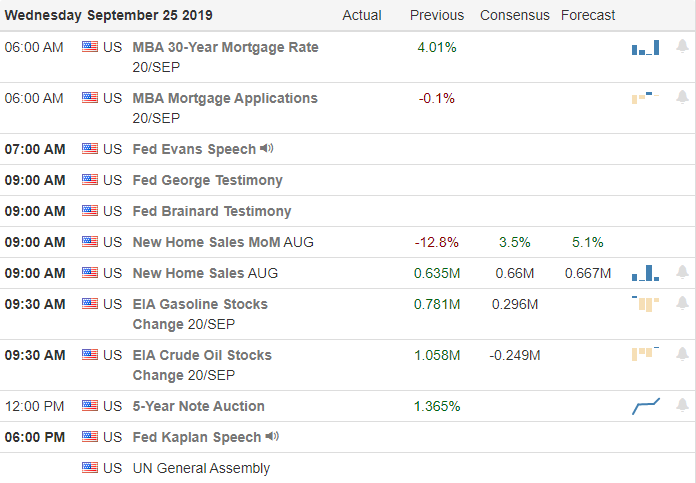

On the Calendar

On the Hump Day Earnings Calendar we just 15 companies reporting quarterly results. Notable reports include KBH and FUL.

Action Plan

Tough talk at the United Nations from President Trump shook the markets yesterday inspired the bulls to move the indexes quickly toward a test of their 50-day morning averages. The pop and drop price action left behind some pretty nasty looking bearish engulfing candles with the QQQ experiencing the worst of the technical damage. Adding insult to injury later in the day it was announced that Congress opened an inquiry of impeachment against the President alleging abuse of power.

As the political drama continues to grow it only adds another layer of what the market hates the most, uncertainty! Unfortunately, that big festering and stinking pile of uncertainty is likely to continue making this market very challenging for traders navigate. The best we can do is stay focused on price, support, resistance, trend, and be willing to take profits quickly when you have them to avoid the potential whip of the news story.

Trade Wisley,

Doug

Comments are closed.