Another pop and drop pattern as yesterday’s 350 point gap finds only sellers amid so much political uncertainty. This morning futures are once again pointing an overnight reversal and gap up open of more than 150 Dow points. The question is will there be buyers there or will it meet with another round of selling? Almost every day I hear from traders that get caught up in the morning hype chase into the morning gap and watch their account getting chopped to pieces.

The fear of missing out is a powerful emotion, and it will destroy a trading account! Stop chasing,focus on the price action with discipline and patience and avoid all the news-driven drama. If the market gaps up wait until you see buyers supporting the gap before entering trades. If gaps down wait for proof that the sellers will support the bearish gap will follow-through selling. Until there is some resolution to all this political uncertainty volatility is likely here to stay so get disciplined or wave goodbye to your money.

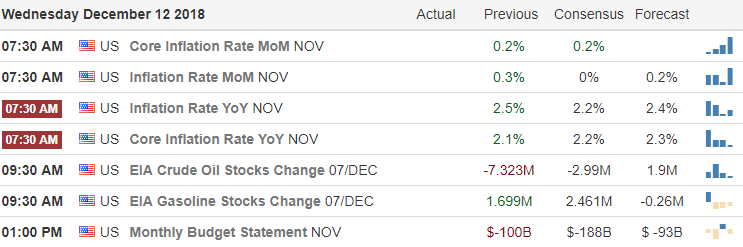

On the Calendar

On the Earnings Calendar,we have 22 companies ready to fess up to their quarterly results today. Make sure you’re checking those reporting against current holdings.

Action Plan

Once again wild volatility plagued the market yesterday with another nasty whipsaw gaping up sharply at the open but finding only sellers. A Whitehouse press conference between the President and Democratic partially fueled the selling shining a spotlight on the political uncertainty we face going forward. However, Asian markets shook the uncertainty rallying sharply across the board on the possible easing trade tensions between the US and China. Europe is also currently bullish across the board this morning even as the British Prime Minister faces a no-confidence vote today.

As a result, the US Futures are once again pointing to a triple point gap up of more than 175 points. Will, there be buyers there today, or will sellers produce another pop and drop pattern? Only time will tell, and the best we can do is stay focused on the price action with discipline and patience. We should expect volatility to continue and very challenging trading until we can get past at least some of the politically generated uncertainty.

Trade Wisely,

Doug

Comments are closed.