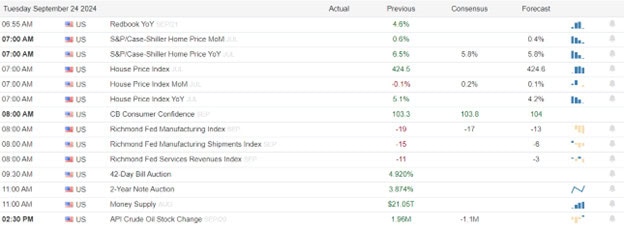

U.S. stock futures saw a slight uptick on Tuesday in response to recent policy changes in China hoping to buoy economic declining confidence. The modest gains were primarily driven by increases in the utilities and financial sectors. Traders are also anticipating new economic data, including the Conference Board’s consumer confidence reading for September and the Richmond Fed manufacturing index, both set to be released later in the morning.

By mid-morning, the pan-European Stoxx 600 index had risen by 0.8%, driven by strong performances in the mining, technology, and household goods sectors. In contrast, telecoms, health care, and utilities were the only sectors in negative territory. Auto stocks also showed significant gains, with BMW up 3%, and both Mercedes Benz Group and Volkswagen increasing by 2%.

The People’s Bank of China announced a reduction in the reserve requirement ratio by 50 basis points, aiming to stimulate economic activity. Meanwhile, Australia’s central bank maintained its benchmark policy rate at 4.35%, aligning with economists’ expectations. Following these announcements, Hong Kong’s Hang Seng index surged nearly 4%, marking its best day in over seven months. In Japan, the Nikkei 225 closed 0.57% higher at 37,940.59, and the Topix rose by 0.54% to 2,656.73, as Japanese markets resumed trading after a holiday.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include AZO & THO. After the bell reports include KBH, PRGS, SFIX, & WOR.

News & Technicals’

A year after identifying geopolitics as the world’s biggest risk, JPMorgan Chase CEO Jamie Dimon reiterated his concerns, stating that “geopolitics is getting worse, they are not getting better” in an interview with CNBC-TV18. Dimon emphasized the escalating geopolitical tensions and urged the U.S. to brace for a prolonged conflict between Ukraine and Russia.

Boeing announced it has extended its “best and final” offer, which includes higher pay and other benefits, but the union rejected it, stating it was not a negotiated proposal. Over 30,000 Boeing machinists initiated a strike on September 13 after decisively rejecting a tentative agreement. The financial repercussions of the strike will hinge on its duration, with Bank of America estimating that it is costing Boeing $50 million per day.

President Joe Biden is preparing to deliver his final annual address to the United Nations General Assembly in New York. In his speech, Biden will aim to reconcile his diplomatic achievements and objectives with the ongoing conflicts in the Middle East, Ukraine, and Sudan. Additionally, foreign leaders are taking the opportunity this week to meet with Biden’s potential successors, Vice President Kamala Harris and former President Donald Trump.

Southwest Airlines’ COO informed staff that the company will need to make “difficult decisions” to enhance profitability. The airline has already announced plans to implement assigned seating, introduce red-eye flights, and offer seats with extra legroom. Southwest is facing pressure from activist investor Elliott Investment Management, which is advocating for a change in leadership.

Big policy changes in China are helping markets around the world continue the recent bullishness but keep in mind that it also signals the major problems with the Chinese economy. With the corporate buyback blackout, a pending GDP and core PCE reading along with uncertainty of coming 4th quarter earnings I would not be surprised to see continued choppy market conditions. Also keep and eye on the growing geopolitical tensions with the potential of pushing energy prices substantial higher.

Trade Wisely,

Doug

Comments are closed.