The Tuesday selloff was overdue, and although a bit painful, it was finally a recognition of the inflation and the resulting pressure the consumer is dealing with in putting groceries on the table. As a result, the indexes experienced some price action damage-breaking trends and current support levels, but only the DIA suffered the technical damage of breaking its 50-day average. Today we have a big round of earnings with the FOMC minutes later to provide some potential price volatility. However, traders will quickly turn their attention to the Thursday GDP report, and the Feds favored PCE number on Friday.

Asian markets followed the U.S., selling off across the board overnight as New Zealand hiked rates to a 14-year high. European markets also feel some selling pressure this morning, pulling back after recording recent record highs. With earnings results rolling out, the U.S. futures suggest a flat to slightly bearish open with last month’s FOMC minutes release later this afternoon. Expect the wild price swings to continue as the bulls and bears fight for control.

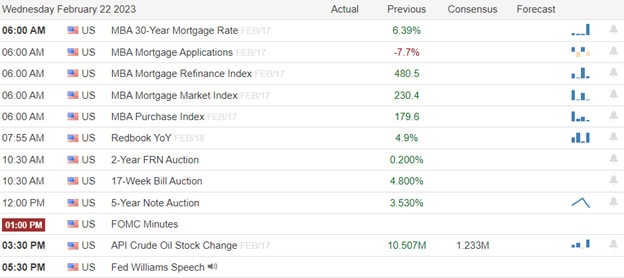

Economic Calendar

Earnings Calendar

Notable reports of Wednesday include BIRD, ATUS, APA, BIDU, BBWI, BMBL, CAKE, CHDN, CDE, CTRA, DVA, BROS, EBAY, ETSY, EXR, FNF, FEDP, GRMN, GIL, LMND, LCID, VAC, MTTR, MAXR, MOS, NTAP, NDLS, NVDA, OSTK, PDCE, PLAB, PXD, RXT, RCII, RGR, STLA, TDOC, TJX, UTHR, U, WFG, WING, & WWW.

News & Technicals’

The maker of Jeep and Dodge, Stellantis, post a record annual profit. The company also announced a 4.2 billion euro dividend payout to shareholders, equating to 1.34 euros per share, subject to shareholder approval. At the same time, the board approved a share buyback of 1.5 billion euros to be executed by the end of 2023.

Amazon employees continued to sound off Tuesday night over the company’s recently announced return-to-office mandate. A group of staffers spammed an internal website with comments expressing anger over the policy. An internal Slack channel showed concerns about parenting, caregiving, and commuting.

Sweden’s Foreign Minister Tobias Billström told CNBC Sweden, and Finland’s NATO membership was “just a matter of time,” with negotiations with ratification holdout Turkey set to resume. Billström said Sweden had “worked to fulfill everything” it agreed to in a memorandum of understanding between the countries last summer, and Swedish membership at the NATO summit in July was the goal. Sweden requested to join the military alliance after 200 years of non-alignment due to the Russian invasion of Ukraine. But it is embroiled in a long-running dispute with Turkey, which holds veto power.

Though yesterday’s selling may have been a bit painful, it was way overdue and an acknowledgment that rates are likely to rise to add pressure to an already stressed consumer. Technically there was some damage to the DIA breaking below its 50-day average. Still, the Tuesday decline reduced the overextended conditions in the SPY, QQQ, and IWM, only suffering from the break of support levels in price action. Today we have a busy earnings calendar while we wait for the FOMC minutes that could provide some price volatility at the end of the day. However, traders will quickly focus on the Thursday GDP report and the Friday PCE numbers. Remember, one day does not make a trend, so it will be interesting to see if the bears have the energy to follow through with a downside push to test the 50-day averages in the SPY, QQQ, and IWM. I would not expect the bulls to give up quickly, so expect the wild price swings to continue as the battle for control continues.

Trade Wisely,

Doug

Comments are closed.