The DIA and IWM had a pretty good day rallying toward overhead resistance levels but investors were mostly on hold in a hurry-up and wait session on lower-than-average volume. Unfortunately, we could see another day of light choppy price action today with nothing to inspire the bulls or bears on either the earnings or economic calendars. Instead, markets are likely to focus on the uncertainty that lies ahead with the Wednesday morning release of the CPI. What happens then is anyone’s guess so plan your risk carefully and try not to overtrade.

Asian markets broke their 3-day losing streak while we slept with Australia leading the buying up 1.50%. With record U.K. wage growth adding to inflation fears European markets trade mixed but though mostly cautiously higher this morning. U.S. futures also trade cautiously higher as we wait for the CPI report tomorrow morning with little else to inspire the interim.

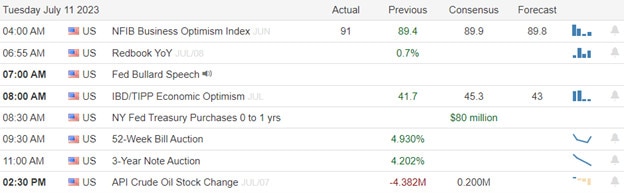

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include BYRN, & AMX.

News & Technicals’

Microsoft is undergoing a major restructuring of its salesforce, as it announced a new round of layoffs that will affect hundreds of employees. The company did not disclose the exact number or location of the affected workers, but some of them took to social media to share their news. The latest cuts are separate from the 10,000 job reductions that Microsoft announced in January as part of its shift to focus on cloud computing and artificial intelligence. The move reflects the changing dynamics of the software industry, as Microsoft faces increasing competition from rivals like Amazon and Google.

HCA Healthcare, one of the largest hospital chains in the US, has confirmed that its patient data has been breached by hackers and is now being offered for sale on the dark web. The dataset contains about 27 million records of patients’ names, dates of birth, social security numbers, insurance information, and visit details. The hack affects patients who visited HCA Healthcare facilities in 22 states, mostly in Florida and Texas, between 2018 and 2021. The company said it is working with law enforcement and cybersecurity experts to investigate the incident and protect its patients’ privacy.

Europe and the U.K. are facing a challenge of rising wages and inflation, as the latest data showed that both regions recorded their highest annual growth in pay in more than a decade. The strong wage growth reflects the recovery of the labor market from the pandemic but also adds to the pressure on the central banks to tighten their monetary policies sooner than expected. Meanwhile, the economic outlook for Germany and the eurozone worsened in July, as the ZEW survey of investors and analysts showed a sharp decline in confidence due to the spread of the Delta variant of Covid-19 and the risk of new lockdowns.

Investors were mostly on hold ahead of important inflation figures and the beginning of the earnings season for the second quarter. Communication services and tech stocks underperformed, while value stocks did better than growth stocks. U.S. used-car prices, which have been a major contributor to core inflation declined slightly and bond yield relaxed. Today has very little for the investors to find inspiration with a light day on the earnings and economic calendar. Don’t be surprised if we see light and choppy price action as we wait for the core CPI numbers before the bell on Wednesday.

Trade Wisely,

Doug

Comments are closed.