The big question of the day, can the bulls follow-through with yesterday’s nice relief rally clearing some of the overhead price resistance? A weak 7-year bond auction has treasury yields ticking higher this morning to worry investors about coming inflation pressures. Additional pressures of the already strained supply chain may factor with the blockage of the Suez Canal that could take weeks to clear. Be careful not to chase or overtrade and remember as the futures pump up the open the pop and drops that occurred all week.

Asian markets caught some seeling relief overnight, seeing green across the board to end the week. European markets are also seeing some modest relief this morning following a better-than-expected global sentiment report. Ahead of possible market-moving economic reports and a light day on the earnings calendar, the bulls are working hard in the futures to continue yesterday’s bounce.

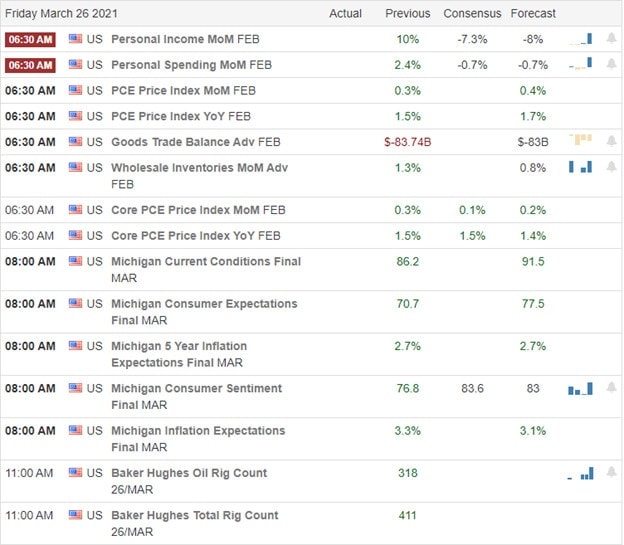

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have a light day with 36 companies listed but only a handful of verified reports. There are no notable reports today.

News & Technicals’

Markets enjoyed a nice relief rally yesterday despite some concerning news. North Korea has kicked up its heels again, firing two ballistic missiles increasing the foreign policy challenges for President Biden. A blockage in the Suez Canal is delaying an estimated $400 million in goods every hour, adding worries to an already strained supply chain. Estimates suggest it could take weeks to clear the blockage. Social Media once again came under fire as pressure increases to change laws placing liability on the company for the content posted. I suspect substantial social media changes are on the way.

The challenge for the market today is follow-though with yesterday’s relief rally bounce. The DIA held nicely on its uptrend, and the SPY, through briefly falling below its 50-day average, proved to hold this critical psychological level by the close. As nice as it was to see the bulls fighting back, they still have some substantial overhead resistance hurdles in their path. The 10-year treasury is ticking up this morning to 1.65% after a weak 7-year bond auction. Big tech could continue to struggle with the rising yields and the growing political pressure they face in congress. Futures suggest a bullish open ahead of potentially market-moving economic reports, so be ready for volatility. As we know, the morning pump has created nasty whipsaws in price action this week. Stay focused and flexible.

Trade Wisely,

Doug

Comments are closed.