Stock futures remained nearly flat on Wednesday with investors waiting the release of new U.S. inflation data. Traders are particularly focused on November’s consumer price index (CPI) reading, expected in the morning. According to economists polled by Dow Jones, the CPI, which measures a basket of goods and services, is anticipated to rise by 0.3% from October and 2.7% year-over-year. Excluding the more volatile food and energy prices, the core CPI is projected to increase by 0.3% month-over-month and 3.3% from the previous year. This data precedes the producer price index report, due on Thursday morning, and both reports are among the last significant economic indicators before the Federal Reserve’s policy meeting next week.

European markets experienced mixed results on Wednesday as traders processed disappointing corporate updates and anticipated the latest U.S. inflation data. Shares of Inditex, the Spanish clothing giant and owner of Zara, dropped by 6% following the release of its interim nine-month and quarterly results. German online retailer Zalando saw a significant decline, falling as much as 10% after announcing its agreement to acquire the fashion group About You. Meanwhile, the U.K. and the European Union are proactively strengthening their cooperation to prepare for potential trade and defense challenges with the incoming U.S. administration. A senior EU diplomat mentioned that the bloc could benefit from closer ties with the U.K. due to Britain’s historical “special relationship” with the United States.

Asia-Pacific markets showed mixed performance on Wednesday as investors reacted to various regional developments. China commenced its annual economic work conference, setting the stage for next year’s economic policies and growth targets. In response, Hong Kong’s Hang Seng index reversed earlier gains, closing 0.76% lower, while China’s CSI 300 index dipped by 0.17%. Conversely, South Korea’s blue-chip Kospi index surged by 1.02%, reflecting investor optimism. Japan’s markets saw modest gains, with the Nikkei 225 rising slightly and the Topix increasing by 0.29%. Meanwhile, Australia’s S&P/ASX 200 index fell by 0.47%, ending the day at 8,353.6.

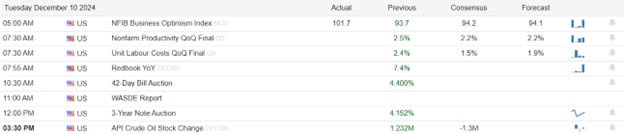

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include CGNT, PLAB, & REVG. After the bell reports include ADBE, NDSN, & OXM.

News & Technicals’

Federal Reserve Chair Jerome Powell is expected to complete his term leading the U.S. central bank, despite earlier suggestions that he might be pressured to resign. This assurance came from Scott Bessent, a prominent hedge fund manager and President-elect Donald Trump’s nominee for Treasury secretary. Bessent confirmed his support for Powell during a conversation with CNBC following a meeting with Senator Mike Crapo of Idaho, stating, “As the President said on Sunday, and I’m in complete agreement with him, that Jay Powell will serve out his term.”

U.S. Treasury yields remained relatively stable on Wednesday as investors awaited the release of November’s consumer price index (CPI) data. By 5:50 a.m. ET, the 10-year Treasury yield had edged up to 4.236%, increasing by more than 1 basis point, while the 2-year Treasury yield also rose by 1 basis point to 4.166%. According to a Dow Jones survey of economists, the CPI is expected to rise by 0.3% from October and 2.7% year-over-year. These inflation figures are among the final significant economic data points before the Federal Reserve’s monetary policy meeting next week, where the central bank will announce its next interest rate decision and provide guidance on future policy and economic outlook on December 18.

Alphabet’s shares saw an uptick on Tuesday following the unveiling of “Willow,” the company’s latest quantum computing chip. While the full potential of quantum computing, such as large-scale simulations and code breaking, may not be realized for years or even decades, the announcement generated significant excitement. Prominent technology leaders, including Tesla CEO Elon Musk and OpenAI CEO Sam Altman, praised the development on social media, highlighting the industry’s anticipation for future advancements in quantum technology.

Major insurance stocks have declined by over 6% since their closing prices last Tuesday, following the tragic shooting of Brian Thompson, CEO of UnitedHealth Group’s insurance division. This drop includes shares of UnitedHealth Group, CVS Health, and Cigna, which are among the largest private health insurers in the U.S. According to Jared Holz, Mizuho’s health-care equity strategist, this stock performance seems to be influenced by renewed negative rhetoric surrounding insurers and their business practices.

As we wait for the new U.S. Inlfation data anything is possible. Keep in mind that tomorrows PPI report could be also be market-moving so plan your risk carefully!

Trade Wisely,

Doug

Comments are closed.